Challenges

As the legacy contact center lacked modern integration channels and suffered from siloed data and manual processes, it hindered sales, service continuity, and omnichannel CX.

Solutions

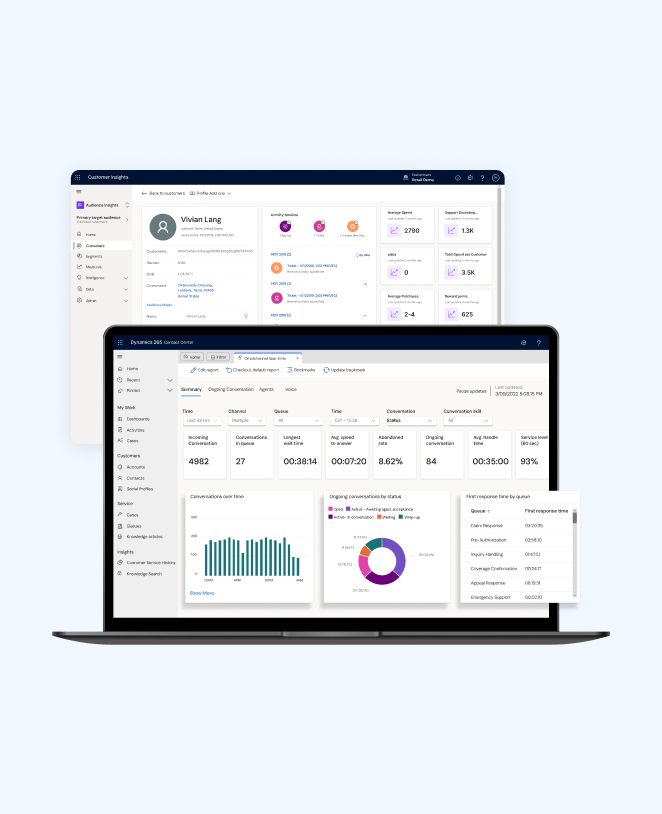

We proposed the Microsoft Digital Contact Centre Platform as an Azure-based solution for omnichannel access, IVR, chatbots, and AI self-service to accelerate insurance operations.

- 240+

- Minutes Saved per Case

- 33.5%

- Increase in First Call Resolution