Read More

Discover what’s next for AI in healthcare in 2026 - Get Access to the Full Report

ON THIS PAGE

- IT Outsourcing Statistics [Editor’s Choice]

- Outsourcing Market Statistics

- General Outsourcing Statistics

- IT Outsourcing Market Overview

- IT Specialists Market Statistics

- Global Outsourcing Trends and Market Size

- List of Outsourcing Statistics: Industry-Specific

- IT Outsourcing Market Stats by Countries

- The Rise of IT Outsourcing Sector

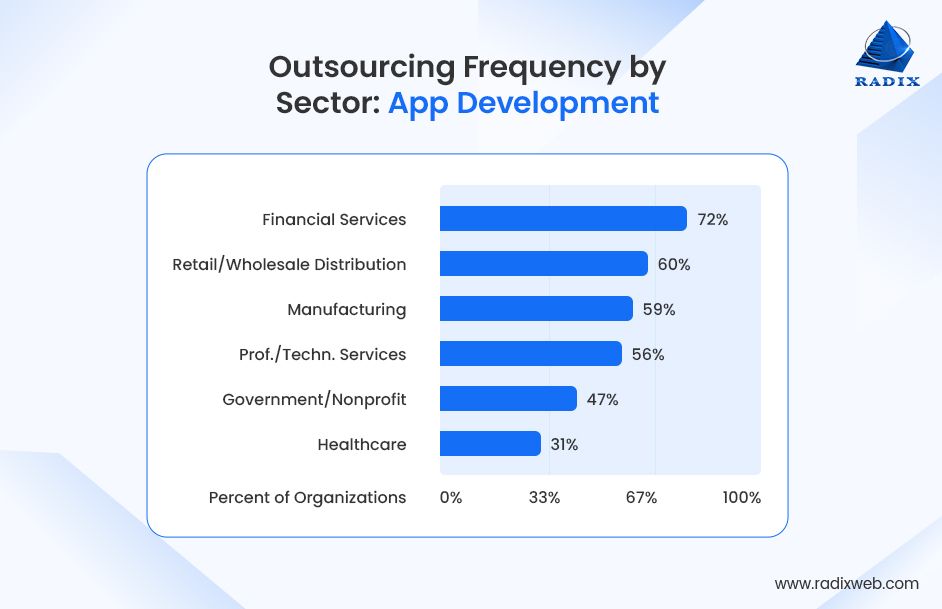

- Outsourcing Frequency by Sector: App Development

- IT Outsourcing Trends

- Start Outsourcing with Radixweb

ON THIS PAGE

- IT Outsourcing Statistics [Editor’s Choice]

- Outsourcing Market Statistics

- General Outsourcing Statistics

- IT Outsourcing Market Overview

- IT Specialists Market Statistics

- Global Outsourcing Trends and Market Size

- List of Outsourcing Statistics: Industry-Specific

- IT Outsourcing Market Stats by Countries

- The Rise of IT Outsourcing Sector

- Outsourcing Frequency by Sector: App Development

- IT Outsourcing Trends

- Start Outsourcing with Radixweb

Quick Overview: The landscape of IT outsourcing is experiencing exponential expansion, with its growth trajectory poised to extend seamlessly into the foreseeable future. This blog explores the latest IT outsourcing statistics, market trends, and industry insights shaping 2026. It highlights how businesses are leveraging global talent, AI, and cloud-driven outsourcing to scale efficiently, reduce risk, and drive long-term digital growth.

The global IT outsourcing market continues to expand as organizations reassess their technology strategies amid economic uncertainty, talent shortages, and the accelerating pace of digital transformation.

Current market forecasts indicate that global IT outsourcing spending is expected to exceed $800 billion by the end of the decade, with steady growth projected through 2025–2029 at a CAGR of around 8%.

The United States remains the largest contributor to this revenue, driven by sustained demand for software engineering, cloud services, cybersecurity operations, and AI-enabled development.

In fact, outsourcing decisions are increasingly shaped by access to specialized talent, faster time-to-market, and the ability to scale securely in a distributed-first world.

Software development, IT administration, and managed infrastructure services together account for over 60% of global outsourcing demand, reflecting how critical digital platforms and always-on systems have become for modern businesses.

Nearly two-thirds of global software development outsourcing demand is focused across three core areas: software development, IT administration, and managed hosting services. This shows how essential scalable digital operations have become for modern enterprises.

To better understand how these shifts are influencing business decisions, this blog explores the latest global enterprise IT outsourcing statistics and trends for 2026, offering practical insights for startups, growing companies, and enterprises planning their next phase of digital expansion.

IT Outsourcing Statistics in 2026 [Editor’s Choice]

- 66% of businesses in the US outsource at least one department.

- Each year, 300,000 jobs in the US are outsourced.

- 24% of small businesses outsource their requirements to enhance efficiency.

- 70% of companies find outsourcing cost-effective, as it reduces the real outsourcing cost compared to hiring and maintaining in-house staff.

- The US market generates $62 billion of the total international income from the $92.5 billion global outsourcing business.

- Information technology is the most outsourced industry and business department, with 37% of IT operations being outsourced and an average IT department budget of 13.6% allocated to outsourcing.

- Around the world, 78% of companies that outsource work have a positive attitude towards their outsourcing partners.

- Between 2021 and 2025, the outsourcing industry is anticipated to expand at a compound annual growth rate of 4%.

- Since the pandemic, 45% of businesses have intended to boost their outsourcing, frequently emphasizing locating skill sets they can't access in-house.

- 90% of businesses can take advantage of more outsourcing opportunities thanks to the cloud because it allows teams to connect with more remote professionals.

- As long as businesses continue to collaborate with contractors, business process outsourcing will reach a value of $620 billion by 2032.

- The global IT services outsourcing market is estimated at USD 422.76 billion in 2025 and projected to grow to USD 778.29 billion by 2032, at a CAGR of 9.1%.

- Another forecast places the broader IT services outsourcing market at USD 661.96 billion in 2025, with expected expansion to USD 1,345.48 billion by 2034 at a CAGR of 8.2%.

- 92% of the world’s largest 2,000 companies already outsource IT services.

- 78% of businesses globally are currently outsourcing or planning to outsource IT functions.

- The offshore software development outsourcing market is projected to be valued at USD 151.9 billion in 2025 and continue growing into the next decade.

- Offshore outsourcing is expected to represent over 45% of the global outsourcing market by 2028.

- 77% of businesses outsource IT functions, with clients allocating an average of 8.1% of their budget toward IT outsourcing.

- North America holds a 33% share of the IT services outsourcing market in 2025, with Asia Pacific the fastest-growing region.

- India continues to be a major outsourcing hub due to skilled talent, competitive rates, and high service adoption. While specific numbers vary by source, India’s market strength is consistently noted across forecasts.

- Despite a global workforce of 47.2 million developers in 2025, 74% of employers report difficulty filling tech roles, reinforcing the strategic role outsourcing plays in accessing talent at scale.

- 51% of tech leaders cite an AI skills gap, further motivating outsourcing of specialized engineering and AI work.

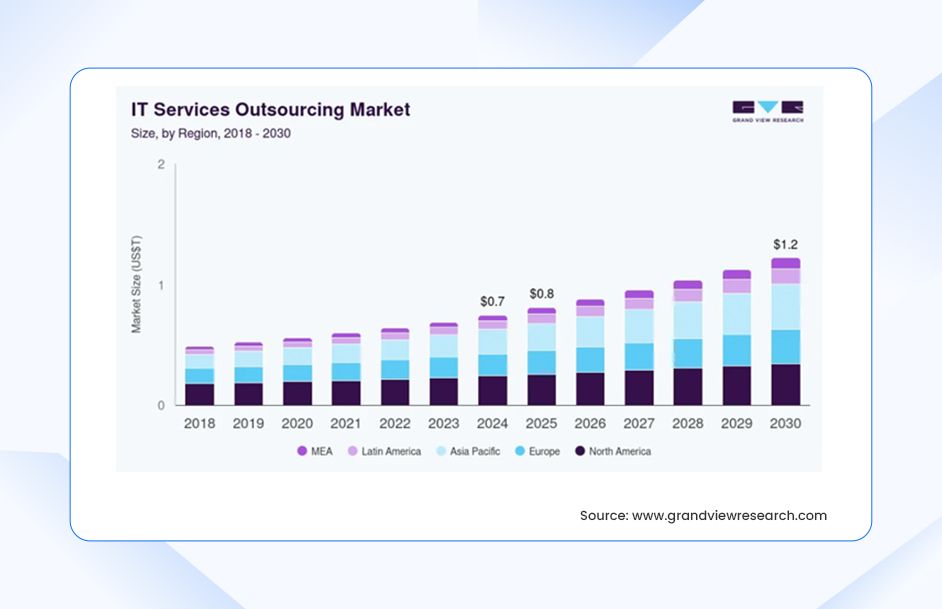

- The global IT services outsourcing market was valued at approximately USD 744.6 billion in 2024 and is projected to reach USD 1.22 trillion by 2030, expanding at a compound annual growth rate (CAGR) of 8.6% between 2025 and 2030.

- The global IT services outsourcing market was valued at USD 744.6 billion in 2024 and is projected to reach USD 1.22 trillion by 2030, growing at a CAGR of 8.6% between 2025 and 2030.

- North America led the market in 2024 due to strong enterprise demand for digital transformation and managed services, while Asia-Pacific is projected to grow fastest as organizations tap broader talent pools, gain cost efficiencies, and address hidden IT outsourcing costs.

Outsourcing Market Statistics

- Two sub-industries, Business Process Outsourcing (BPO) and Information Technology Outsourcing (ITO), dominate the global outsourcing market.

- ITO includes cloud computing services, web and mobile app development, cyber security, data backups, and many more.

- BPO encompasses a wide range of operations, including marketing, customer support, payroll and other HR management services, and logistics.

- The global business process outsourcing (BPO) market is projected to exceed $525 billion by 2030, underscoring its expanding role in enterprise operations.

- Nearly all Global 2000 enterprises (92%) rely on IT outsourcing to support scale, innovation, and operational resilience.

- Business process outsourcing contributes approximately 9% of Philippines’ GDP, making it one of the country’s most critical economic drivers.

- Over one-third of small businesses (37%) outsource at least one core business function to improve efficiency and reduce operational overhead.

- The services outsourcing sector in China continues to expand rapidly, adding more than one million new professionals every year to meet global demand.

General Outsourcing Statistics

- IT outsourcing remains nearly universal among large enterprises, with 92% of Global 2000 companies relying on external IT service providers. While business process outsourcing continues to play a role, its adoption is notably lower, with only 59% of G2000 organizations maintaining BPO contracts—highlighting a stronger preference for technology-focused outsourcing.

- Cloud computing has become a central pillar of outsourcing strategies, with 90% of companies identifying it as a key enabler of scalability and operational agility. As organizations accelerate toward cloud-first models, concerns around data security, compliance, and risk management remain critical factors shaping provider selection.

- Cybersecurity outsourcing is also gaining momentum. 83% of IT leaders are now considering outsourcing security operations, driven by growing threat complexity, constrained budgets, and ongoing talent shortages. Even as most enterprises retain in-house security teams, the demand for specialized external expertise continues to rise.

- Nearly 60% of organizations outsource application development, driven by the high cost and scarcity of specialized developer talent. Adoption varies by industry, with financial services leading at 72%, while healthcare trails at 31% due to stricter regulatory and security requirements.

- The global outsourcing market is expected to exceed USD 1 trillion by 2030, reflecting sustained demand across IT, business process, and knowledge-based services.

- Over 70% of companies worldwide outsource at least one business function, making outsourcing a mainstream operational strategy rather than a tactical choice.

- Cost reduction remains a key driver, but only about one-third of organizations now cite it as the primary reason for outsourcing, down significantly from previous years as access to talent and innovation take priority.

- 92% of Global 2000 companies outsource IT services, reinforcing outsourcing’s role as a core enterprise operating model.

- Small and mid-sized businesses increasingly adopt outsourcing, with approximately 37% of SMBs outsourcing at least one business process to improve efficiency and scalability.

- Asia-Pacific remains the fastest-growing outsourcing region, driven by India, China, and Southeast Asia, while North America continues to dominate total spending.

- More than 50% of enterprises plan to increase outsourcing investments over the next two years, particularly for digital transformation, cloud, and cybersecurity services.

IT Outsourcing Market Overview

- The top three categories in the IT outsourcing market are web hosting, software development outsourcing, and administration outsourcing. They make up 63.5% of the market's total worth.

- More than 75% of executives said they would outsource IT services. The top three of them are IT infrastructure services, app and custom software development, and cybersecurity.

- Last year, 67% of executives reported an increase in the budget for Operated Services, 57% reported a rise in the budget for Managed Services, and 32% reported an increase in the budget for traditional outsourcing. In a nutshell, organizations are investing more money in Information Technology outsourcing services overall.

- Access to new technical options and human and cost-saving potential are the two most significant factors in favor of IT outsourcing.

- IT services make up around three-quarters of all global outsourcing contract values.

- Of the $92.5 billion in total contract value generated by global outsourcing providers, IT services accounted for $66.5 billion, highlighting the sector’s continued dominance. Business process outsourcing (BPO) contributed the remaining $26 billion, reflecting steady but comparatively slower growth.

- 92% of Global 2000 enterprises currently outsource at least one IT function, underscoring outsourcing’s role as a core enterprise operating model rather than a tactical decision.

- By 2025, talent access and speed-to-market have overtaken cost reduction as the top drivers of IT outsourcing, particularly for AI, cloud-native development, and cybersecurity services.

IT Specialists Market Statistics

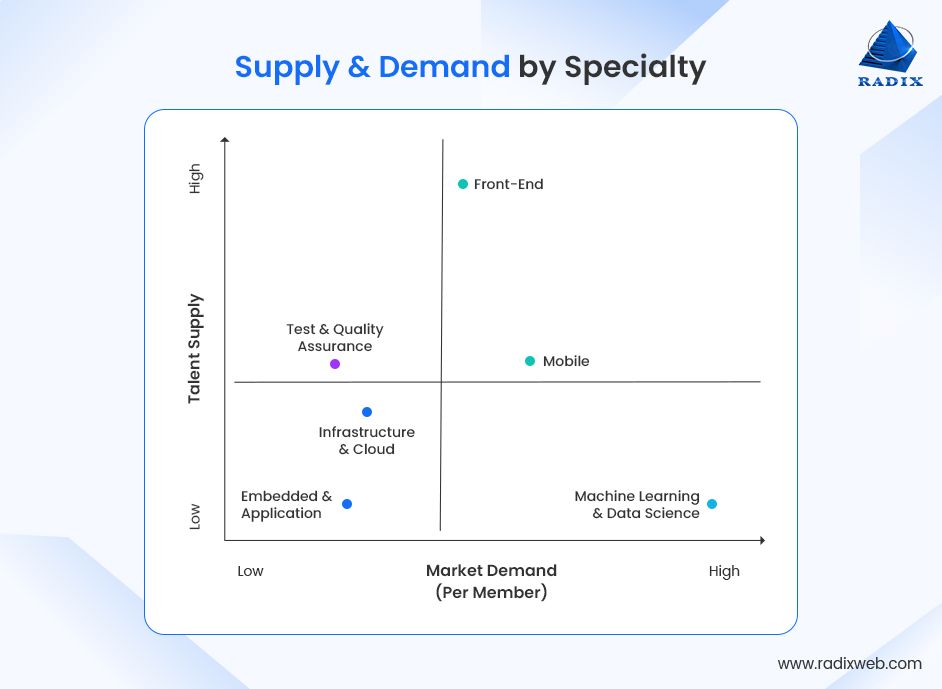

The demand for highly skilled specialists proficient in complicated technologies is increased across the USA, Canada, and Western Europe. Particularly noteworthy is the heightened demand for developers in Eastern Europe.

According to a report from the US Bureau of Labor Statistics, software development ranks among the most sought-after professions and commands the highest median earnings. These regions are grappling with a pronounced shortage of workforce, with demand far outpacing supply, prompting a significant escalation in service prices by the existing specialists.

The Bureau of Labor Statistics predict that employment growth in the USA will increase by 31% in 2026. About 255,400 IT jobs are expected to be opened up in this span. We will also witness an increase in wages in the IT sphere.

While overall salary growth in the United States is 1.8%, this growth is roughly 3%.

Specialty, education, employers, and geographic areas should all be considered. The best-paying areas are undoubtedly metropolitan areas. The cost of hiring a software developer is among the highest in cities like San Francisco, NYC, Seattle, and San Jose, California.

Global Outsourcing Trends and Market Size

According to research and market surveys, the global market for outsourcing services will be worth $904.948 billion in total by 2027.

The situation of the global outsourcing market today is comparable to an ecosystem that is buzzing with innovation. It has transcended geographical boundaries and developed into a significant element influencing business growth.

- The outsourcing sector has undergone a transformation thanks to technology. Processes have been updated due to automation, artificial intelligence, and cloud computing.

- The flexibility of engagement models is increased to meet business requirements. Businesses can select the model that best suits their needs, from long-term contracts to project-based agreements. This is the way to encourage continuity and teamwork.

- Outsourcing any service now requires careful consideration of data protection. Offshore businesses now use data protection processes and strong security measures.

AI & Automation in IT Outsourcing

AI and automation are redefining IT outsourcing, from labor-centric delivery models to intelligent, outcome-driven partnerships. In 2026, enterprises increasingly evaluate outsourcing providers based on automation maturity, AI in web development, broader AI capabilities, and measurable business impact—not just cost efficiency.

- Over 70% of organizations now expect AI and automation to be embedded in their IT outsourcing engagements, particularly across application development, infrastructure management, and service delivery optimization.

- More than 65% of enterprises using IT outsourcing report improved operational efficiency due to AI-driven automation, including automated testing, monitoring, and incident response.

- AI-enabled automation is expected to reduce IT service delivery costs by 20–30%, making intelligent outsourcing a key lever for margin optimization.

- Over 50% of new IT outsourcing contracts now include AI-based service components, such as predictive analytics, intelligent ticketing, and automated vulnerability detection.

- Nearly 80% of CIOs believe automation-led outsourcing will be critical to scaling digital operations, especially in cloud-native, DevOps, and cybersecurity environments.

- AI adoption in outsourced software development has increased development speed by up to 40%, driven by automated code generation, testing, and CI/CD optimization.

- 83% of organizations now expect their outsourcing partners to deliver services embedded with AI capabilities, making intelligent delivery a baseline requirement rather than a differentiator.

- 60% of companies are extending AI-driven outsourcing initiatives through existing vendors, favoring trusted relationships over rapid vendor churn.

- 57% of organizations are establishing new vendor partnerships specifically to access AI expertise, signaling a parallel shift toward specialized providers.

- Organizations leveraging AI in outsourcing engagements report satisfaction levels that are 7% higher, reflecting early gains in service quality and responsiveness.

- Only one-quarter of companies report measurable cost reductions from AI-enabled outsourcing, indicating that financial efficiencies are still emerging.

- Just 20% of organizations have implemented a formal digital workforce strategy, highlighting a significant execution gap between AI ambition and operational readiness.

List of Outsourcing Statistics: Industry-Specific

This section highlights key outsourcing trends across major industries, offering an overview of how organizations leverage external expertise to improve efficiency and reduce operational complexity.

Financial Services (BFSI)

- Over 70% of financial institutions outsource application development and maintenance, driven by demand for digital banking, fintech integrations, and regulatory scalability.

- More than 60% of banks use third-party providers for cloud and infrastructure services, while maintaining strict governance controls.

Healthcare & Life Sciences

- 31% of healthcare organizations outsource application development, reflecting a cautious approach due to data privacy and regulatory requirements.

- Over 55% of healthcare providers outsource IT infrastructure or managed services to support EHR systems, interoperability, and uptime.

Retail & eCommerce

- More than 65% of retailers outsource software development or managed IT services, primarily to accelerate omnichannel, mobile, and personalization initiatives.

- Retailers using outsourced IT services report up to 30% faster time-to-market for digital features compared to fully in-house teams. Therefore, choosing the right IT outsourcing company improves your time-to-market.

Technology & SaaS

- Nearly 80% of SaaS companies outsource at least one core IT function, including development, QA, DevOps, or support.

- Over 50% of SaaS outsourcing contracts now include AI or automation components, such as automated testing and monitoring.

Manufacturing & Industrial

- Around 60% of manufacturers outsource IT services to support ERP modernization, IoT platforms, and smart factory initiatives.

- Manufacturers leveraging outsourced digital services report 20–25% operational efficiency gains through automation and analytics.

Small & Mid-Sized Businesses (SMBs)

- 37% of small businesses outsource at least one business process, most commonly IT support, development, or accounting.

- SMBs that outsource IT functions report up to 25% lower operational costs compared to fully in-house delivery models. This makes a good choice to outsource software development for SMBs

IT Outsourcing Market Stats by Countries

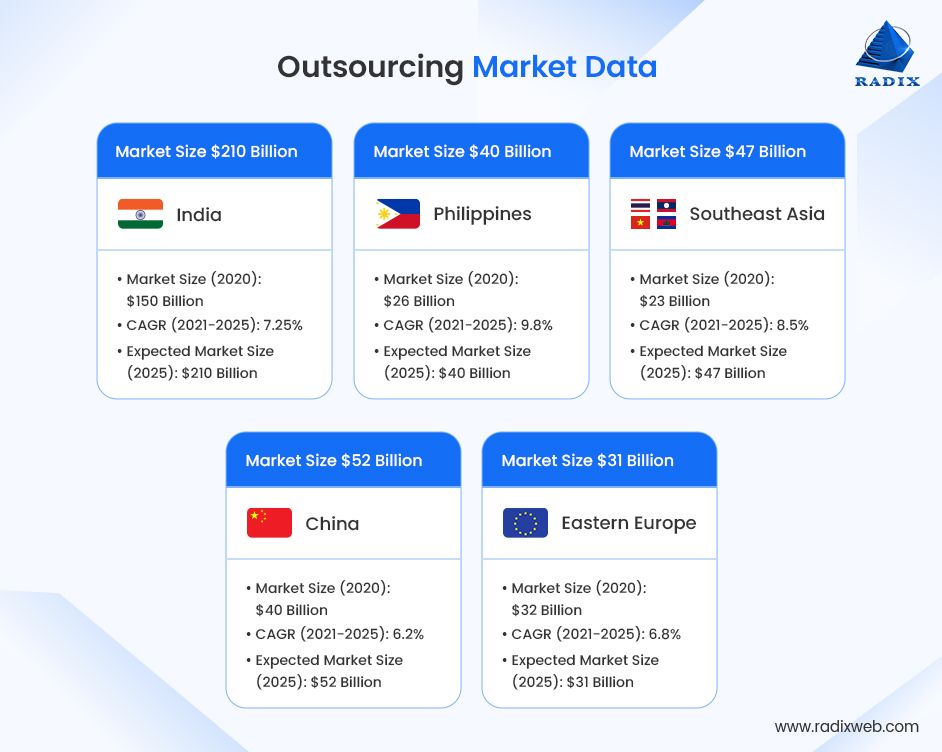

India: India is the most favorite and preferred country for software development outsourcing. It’s known as the “Outsourcing Capital of the World”. It’s popular for its myriad of talents, skilled professionals, and technocrats. India is popularly known for software development, IT services, customer support, and back-office operations.

Philippines: The Philippines continues to draw businesses looking for high-quality, reasonably priced outsourced solutions. It enjoys substantial government support and ties to Western nations culturally. It serves as a hub for call centers, knowledge-based services, and business process outsourcing (BPO).

Southeast Asia: Southeast Asian nations compete fiercely in the outsourcing industry. Thailand, Vietnam, and Malaysia are well known for their services. They are experts in digital marketing, business support operations, and IT outsourcing. They become a distinctive attraction; as a result, attracting both domestic and international clients.

China: When it comes to manufacturing outsourcing, China has become a major player in the outsourcing industry. China has become the go-to location for businesses looking to optimize production and gain access to the largest consumer market in the world. China is renowned for its efficient, cost-effective production capabilities and unparalleled supply chain management expertise.

Eastern Europe: Eastern European countries are not left behind when it comes to the outsourcing industry. With great expertise in software development and IT services, it has become an attraction to many clients worldwide. Ukraine, Poland, and Romania are countries that offer high-quality solutions along with cost advantages.

The Rise of IT Outsourcing Sector

49.6% of businesses stated that they would raise their outsourcing percentage in the coming year. Only 10.4% of respondents wished to reduce outsourcing, while 40% saw no change. Therefore, it is reasonable to predict that software development outsourcing is a good choice, and its market will expand.

Outsourcing Frequency by Sector: App Development

The tendency of a business to IT outsourcing services completely depends on the industry it operates in. The above graph displays the industries that outsource app development with average frequency. Retail/wholesale businesses come in second at 60%, followed by the financial services sector at 72%. Companies in the healthcare industry are included in the list with a relatively low 31%.

IT Outsourcing Trends

- Businesses are accelerating their digital transformation in 44% of cases already.

- 33% of companies want to increase governance, risk, and security. A crucial development in IT outsourcing during that time was increased security.

- 30% of companies want to create training materials to assist remote employees.

- 36% of companies intend to boost IT operations and system performance.

- 32% of companies intend to use standardized, safe, and simple solutions to connect employees.

- 27% of companies want to improve disaster recovery strategies to consider additional scenarios.

- Only 34% of organizations now cite cost reduction as the primary reason for IT outsourcing, down sharply from previous years, as access to talent, speed, and innovation take priority.

- 90% of enterprises consider cloud computing a critical enabler of their IT outsourcing strategy, accelerating demand for managed cloud and cloud-native development services.

- More than 60% of new IT outsourcing engagements now include cloud migration or cloud management components.

- 83% of IT leaders are considering outsourcing cybersecurity operations, driven by skills shortages and rising threat complexity.

- Managed security services are among the fastest-growing segments of IT outsourcing, with double-digit growth projected through 2026.

- Over 40% of enterprises are actively diversifying outsourcing locations to reduce geopolitical risk, shifting toward nearshore and multi-region delivery models.

- More than 50% of new IT outsourcing contracts are outcome-based, tying vendor compensation to performance, SLAs, and business impact rather than effort alone.

Rise of Cloud Services

Cloud migration is a complex process. With the ongoing digital transformation and IT outsourcing trends, many organizations are on the verge of adopting cloud-based solutions. Hence, they plan to migrate from on-premises architecture to cloud-based data storage.

Cloud computing presents a range of advantages, encompassing enhanced data security, swifter data processing capabilities, and the facilitation of process modernization through the seamless integration of diverse business applications.

The global cloud computing market is now valued at over USD 600 billion in 2024 and is projected to exceed USD 1.6 trillion by 2030, driven by enterprise cloud migration, AI workloads, and managed cloud services.

The global Software-as-a-Service (SaaS) market reached approximately USD 197 billion in 2023 and is expected to grow beyond USD 300 billion by 2027, with continued expansion in SaaS application development, vertical SaaS, and AI-powered platforms.

Enterprise spending on SaaS application development and customization continues to rise as organizations prioritize scalable, cloud-native applications and faster product innovation cycles.

The markets for Platform as a Service (PaaS), Software as a Service (SaaS), and Infrastructure as a Service (IaaS) are experiencing an annual growth rate of 24%. Therefore, the cloud computing market will reach $623.3 billion after two years.

Artificial Intelligence: RPA and AI-Powered Chatbots

After ChatGPT was released, an IT outsourcing trend emerged. Giant companies like Microsoft, IBM and Samsung have heavily invested in global AI start-ups. Technology giants frequently use AI-based chatbots and robot automation to provide flawless and affordable customer support.

As per the report, in 2020 alone, giant companies like Google, Amazon, Apple, Microsoft, and Facebook acquired around 13 AI startups.

Remote Work and Cybersecurity

As per the survey conducted by Gallup,

- 5 in 10 people are working hybrid

- 3 in 10 people are working remotely

- 2 in 10 are entirely on-site

As per the data from AT&T, the hybrid work model will grow from 42% in 2021 to 81% in 2024.

Start Outsourcing with RadixwebIT outsourcing today is about driving measurable business outcomes, not just reducing costs. To succeed, organizations need a partner that combines technical depth, delivery discipline, and a clear understanding of enterprise priorities.With over 25 years of experience in the global market, Radixweb has gained profound insights into the hidden pitfalls of software development, becoming a leading outsourcing service provider.Our foundational principles include ensuring that all decisions are in line with clients' business needs and objectives. We emphasize complete client engagement throughout the development process and prioritize transparent collaboration to create a superior software product that meets client requirements. We also recognize the value of the Agile Manifesto as a tool to guide development, promoting adherence to agile principles over bureaucratic development process standards.If you’re ready to transform outsourcing into a strategic advantage, start outsourcing with Radixweb and move forward with confidence.Connect with us, and we will demonstrate the essence of transparent and effective communication in outsourcing development.

Frequently Asked Questions

Why should companies choose Radixweb for IT outsourcing?

What IT services can be outsourced to Radixweb?

How does Radixweb ensure data security and compliance?

How does Radixweb help control outsourcing costs?

Can Radixweb work with in-house or distributed teams?

How does Radixweb support scalability and long-term growth?

What industries does Radixweb serve through outsourcing?

Ready to brush up on something new? We've got more to read right this way.