Our fintech software development services create digital financial solutions using AI, blockchain, and cloud to boost security, efficiency, and user experience. Since 2000, Radixweb has delivered 200+ solutions across lending, payments, and digital banking. Our cross-industry expertise helps businesses launch high-tech products in the fintech market.

Challenges

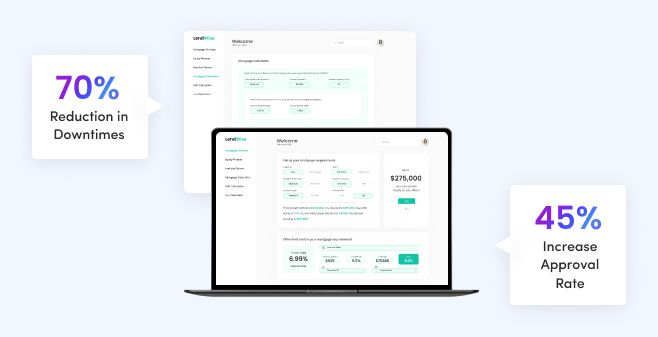

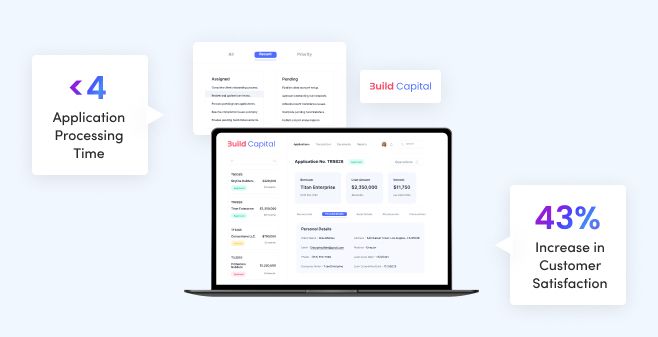

Managing rapid growth while modernizing mortgage workflows, reducing processing time and underwriting effort, improving lending experience, and meeting compliance requirements.

Solutions

We reduced loan turnaround time by delivering a full-scale digital mortgage platform with automated workflows, applied OCR, cloud and blockchain infrastructure, and ML-powered risk scoring.