Read More

Discover what’s next for AI in healthcare in 2026 - Get Access to the Full Report

Top 10 FinTech Software Development Companies in 2026

Vishal Siddhpara

ON THIS PAGE

- How Did We Create This Guide?

- 5 Characteristics of An Ideal FinTech Software Development Company?

- Quick Look at the Top FinTech Software Development Firms

- Top 10 FinTech Software Development Companies

- A Checklist to Choose the Right FinTech Service Provider

- Getting Started with FinTech Software Development

ON THIS PAGE

- How Did We Create This Guide?

- 5 Characteristics of An Ideal FinTech Software Development Company?

- Quick Look at the Top FinTech Software Development Firms

- Top 10 FinTech Software Development Companies

- A Checklist to Choose the Right FinTech Service Provider

- Getting Started with FinTech Software Development

Summary: The FinTech software development partner you pick today will decide if you cruise through audits or scramble for fixes. It will decide if your data stays bulletproof or ends up in the headlines. It decides whether adding your next 1,000 customers will feel as easy as the first 10. And to help you make the right choice, we will cut through the hype in this guide. We have compared hundreds of market players. Based on that analysis, we now have the top 10, including Radixweb, DataArt, and EPAM Systems, among others. Dive in to learn more about the top 10 and get clear next steps to launch your MVP with confidence.

FinTech software development is projected to worth USD 917.17 billion by the end of 2026. Banks, startups, retailers, everyone wants in. How do you get in? With FinTech software development, of course. But here's the problem: There are hundreds of FinTech software developers, if not more. And every vendor talks about AI, blockchain, and zero-trust.

But the truth is that only a few companies can actually deliver what they claim. Especially, when you want software that can survive overnight compliance rule changes or tenfold traffic spikes.

Imagine launching a neobank on Monday and waking up Tuesday to an AML update. Or pushing a new trading feature, only to face a DDoS attack at market open. If your tech partner isn’t ready, you’ll be firefighting, not innovating.

In this blog we help you find exactly those types of FinTech software development companies.

If you search for the best FinTech development companies on the Internet, you'll find most of them claiming the same things. Some with good marketing copy, others with stunning graphics. But in this blog, it isn't about marketing. It’s about real performance. We evaluated hundreds of options (not just in terms of size, scale, or market buzz!) but in terms of tangible value and alignment with diverse business needs. That’s how we arrived at the top 10. No fluff, just facts.

Why This Article Matters (and Why Radixweb Belongs!)

We aren't writing the 1st list of top FinTech companies. This also won't be the last one. But here's where and how we are different:

Most “Top 10 FinTech vendors” lists read like paid ads. Logos, buzzwords, and empty promises.

We chose a different path:

- We evaluated security readiness through certifications like ISO 27001 and SOC 2

- We reviewed verified client satisfaction scores and post-project feedback to assess service reliability.

- We examined real case studies demonstrating successful deployments and tangible outcomes. Not just slide decks.

And yes, we included Radixweb on the list. Not because we could but because we deserved a spot according to the rigorous standards we set.

At Radixweb, we've guided numerous FinTech projects through the rigorous demands of surprise audits, red-team security drills, and mission-critical day-one launches. Our teams have consistently met the mark. We've ensured compliance. We've built resilient systems. And we've designed for scalability from the outset. This commitment to excellence is what rightfully places Radixweb among the financial software development firms that you can truly trust.

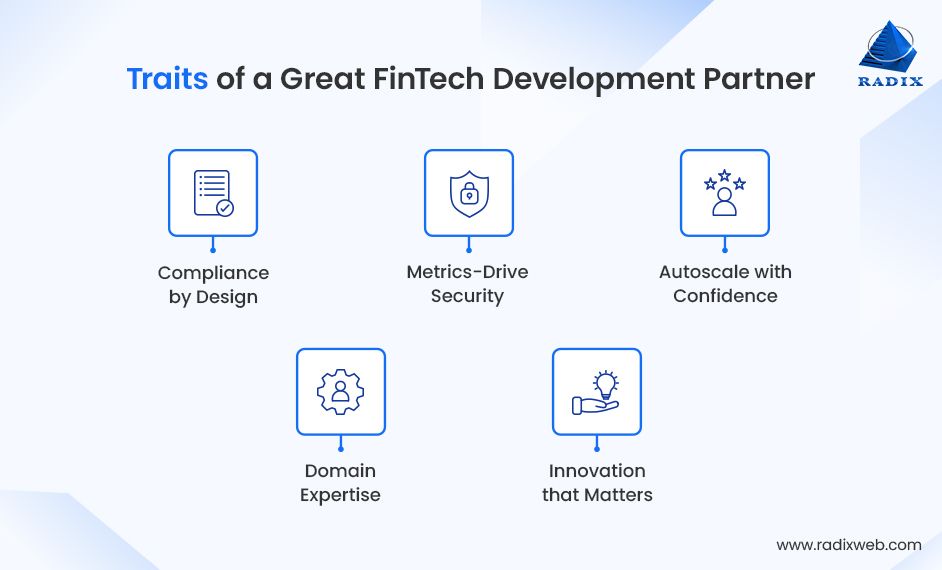

Five Traits of a Great FinTech Development Partner

When you're sizing up reliable FinTech vendors for long-term partnerships, it’s easy to get swayed by big claims and shiny presentations. But the real question is: who can deliver when it counts? The right partner isn’t just a vendor. They’re an extension of your vision. They should understand not just the technical nuances but also the regulatory, security, and scalability challenges that define the FinTech space. They shouldn’t just be talking about the FinTech development trends but also helping you bank on the trends and even create new trends.

We’ve identified 5 key traits that separate competent developers from strategic partners. These are the benchmarks we used to compare the hundreds of options in the market.

1. Compliance by Design

A vendor tacks on checklists. A partner embeds rules into code.

- They map PCI DSS, GDPR, and AML directly to microservices.

- They use policy-as-code so CI pipelines block non-compliant merges.

- They version audit logs in append-only stores.

2. Metrics-Driven Security

Vague security claims don’t cut it. You need numbers:

- Mean Time to Detect (MTTD)

- Mean Time to Recover (MTTR)

- Daily static and dynamic scans plus monthly red-team exercises.

Consider the above metrics and only then accept the 'we do it right' claims of the company.

3. Autoscale with Confidence

When traffic surges, you need instant scale, not slow reactions.

- Autoscaling rules tied to business events like queue depth and transaction rates.

- Chaos engineering in staging to validate self-healing.

- Edge caching and multi-region clusters for low latency.

4. Domain Expertise

FinTech isn’t generic. It demands Protocol Mastery:

- ISO 20022, SWIFT FIN/MT, FIX session handling.

- KYC/KYB workflows, AML screening, PEP checks.

- Payment orchestration across ACH, SEPA, RTP, and card networks.

5. Innovation That Matters

If your vendor isn’t innovating, you’re falling behind. The right partner will have:

- 15–20% sprint capacity reserved for AI risk models, DeFi pilots, and embedded SDKs.

- Quarterly innovation drills with real outcomes.

- Pilot-ready prototypes, not just slide decks.

Overall, you need to look for FinTech software development companies that don’t just say yes to all your FinTech app ideas. You want someone who can help you objectively assess the idea and bring it to life, if it is viable.

Before you select a FinTech development company, check out the guide above to understand the basics of FinTech development. The guide will help you plan your FinTech software and understand what you need to look for in the right partner.

Leading Innovators in FinTech Software Development

Here’s a quick summary of the top companies driving the next wave of financial technology.

| Company | Location | Founded In | Employee Count | Why They Stand Out |

|---|---|---|---|---|

| Radixweb | USA | 2000 | 501–1000 | AI-powered, compliant FinTech platforms with scalable solutions for banks & lenders |

| DataArt | USA | 1997 | 5,001–10,000 | Legacy modernization, cloud-native platforms, OpenFin and modular UX expertise |

| EPAM Systems | USA | 1993 | 10,000+ | Enterprise-scale, distributed FinTech solutions with high security and cloud-native delivery |

| Hexaview Technologies | USA | 2010 | 201–500 | AI/ML-driven BFSI solutions, wealth management, advanced reporting and automation |

| Armada Labs | USA | 2002 | 51–200 | Full-cycle FinTech software, lending & credit decisioning platforms, KYC/AML integrations |

| F22 Labs | India | 2014 | 51–200 | Startup-focused MVPs and SaaS acceleration, rapid market entry for FinTech ventures |

| Geniusee | USA | 2017 | 51–200 | Cloud-based FinTech solutions, AWS/GCP integration, ISO-certified agile delivery |

| Atomic Object | USA | 2001 | 51–200 | Human-centered design, secure FinTech apps, US-based agile teams with transparent processes |

| Apadmi | UK | 2009 | 201–500 | Mobile-first, secure, and compliant FinTech applications with award-winning UX |

| PowerGate Software | Vietnam | 2011 | 201–500 | Digital payments, open banking, blockchain solutions, flexible offshore and hybrid delivery |

Best FinTech Software Development Companies in 2026

Below we have mentioned the top 10 FinTech software outsourcing companies suitable for all sorts of FinTech software needs. Remember: Not every partner may be suitable for every project, so make sure you choose the one that fits your unique needs.

1. Radixweb

| Location | Employee Count |

|---|---|

| Frisco, Texas, USA | 501-1000 |

Radixweb is a globally recognized leader in FinTech software development. We offer scalable, AI-powered solutions to banks, lenders, and financial institutions. With 25 years of industry experience, we blend deep domain expertise with innovation, FinTech compliance-ready software solutions, and security for clients across North America, Europe, and Asia.

Why Radixweb?

At Radixweb, we stand out for our holistic approach where we blend premium technical talent with rock-solid processes. Plus, we ensure PCI-DSS, SOC 2, GDPR compliance with our deep FinTech expertise. We excel at rapid time-to-market, personalized financial platforms, and complex integrations. This is what makes us the ideal partner for organizations seeking a top-tier, future-ready FinTech solution.

We have proven expertise in:

- Regulated industries

- Security-first architectures

- Domain-specific protocols

Plus, we ensure your product isn’t just functional, it’s future-ready. We are among the most trusted enterprise FinTech development companies, because we’ve helped enterprises pass stringent audits. We've built infrastructure that scaled seamlessly. We've deployed compliant, high-performing applications.

That's the kind of experience that gives you the confidence that your software is in the right hands.

But don't just take our word for it. We recently worked with a commercial collection company to deliver custom collection agency software that was built right into their website. Here’s what the Director of MIS had to say about the engagement:

Read the complete review from Jana here.

2. DataArt

| Location | Employee Count |

|---|---|

| New York, NY, USA | 5,001–10,000 |

DataArt is a global engineering firm delivering next-gen data, analytics, and AI platforms for complex FinTech ecosystems. Their 5,000+ professionals specialize in digital transformation, cloud-native development, and customized FinTech software development services.

Why DataArt?

DataArt’s strength lies in legacy modernization and modular FinTech UIs. They've helped several traditional finance institutions migrate to scalable, interoperable digital platforms. Their certified OpenFin partnership and micro-frontend innovations set them apart. And makes them a top choice for organizations prioritizing UX and seamless integration.

3. EPAM Systems

| Location | Employee Count |

|---|---|

| Newtown, PA, USA | 10,000+ |

EPAM Systems is a global IT consultancy with large-scale FinTech expertise. They are supported by a vast network of technologists who have delivered innovative financial management, payment, and lending platforms.

Why EPAM?

EPAM excels in deploying distributed cloud-native FinTech solutions at scale, leveraging the latest cloud ecosystems. Their agile engagement models and blended teams are a strong fit for organizations that need robust security, high scalability, and rapid transformation.

4. Hexaview Technologies

| Location | Employee Count |

|---|---|

| New York, NY, USA | 201–500 |

Hexaview is a digital transformation specialist focused on FinTech, wealth management, and capital markets. With 14+ years of experience and an Inc. 5000 status, they offer AI, ML, data analytics, and Salesforce-driven solutions for BFSI clients.

Why Hexaview?

Hexaview stands out through its strong focus on data-driven automation and advanced reporting products. That enables institutions to modernize workflows and derive actionable insights. Their record with prominent financial exits underlines technical and business acumen vital for forward-thinking FinTech partners.

5. Armada Labs

| Location | Employee Count |

|---|---|

| Estero, Florida, USA | 51–200 |

Armada Labs specializes exclusively in FinTech software solutions. They boast 20+ years' domain expertise in developing cloud, lending, and credit decisioning products for startups and large financial brands.

Why Armada Labs?

Armada Labs’ unique value lies in their customer-first, full-cycle approach. They are especially suited for clients prioritizing security, compliance, and strategic advisory. Their tailored development (such as AI-driven credit scoring and integrations with KYC/AML providers) ensures bespoke solutions for complex financial challenges.

6. F22 Labs

| Location | Employee Count |

|---|---|

| Mylapore, Tamil Nadu, India | 51–200 |

F22 Labs is among the top FinTech software providers for startups. They specialize in rapid MVP development, SaaS, and AI-driven product acceleration. Their in-house team delivers web/mobile FinTech prototypes with speed and flexibility

Why F22 Labs?

F22 Labs’ “startup rocket fuel” approach enables FinTech entrepreneurs to test, iterate, and launch MVPs within weeks. They are ideal for disruptors or early-stage ventures who value rapid market entry and hands-on collaboration over large-scale presence.

7. Geniusee

| Location | Employee Count |

|---|---|

| Austin, Texas, USA | 51–200 |

Geniusee delivers custom FinTech solutions for enterprises, leveraging cloud, AI, and certified AWS partnerships. With ~200 experts and ISO certifications, they serve a diverse clientele includng startups, SMBs, and scaling finance companies.

Why Geniusee?

Geniusee’s strength is rapid, high-quality delivery with an agile footprint in both North America and Europe. Their ability to build MVPs in 2–3 months, commit to strict regulatory standards, and integrate AWS/GCP cloud makes them especially adept for FinTechs expanding globally or seeking speed to value.

8. Atomic Object

| Location | Employee Count |

|---|---|

| Grand Rapids, Michigan, USA | 51–200 |

Atomic Object is a US-based, employee-owned software consultancy. They develop secure, ROI-focused FinTech and financial services software. With more than 20 years’ experience, their multi-office team delivers custom digital products for companies of all sizes.

Why Atomic Object?

Atomic Object’s unique proposition is meticulous, human-centered design and US-based agile teams. This leads to transparent project management, cross-platform strength, and seamless collaboration. That's what makes them ideal for FinTechs needing both regulatory expertise and top-tier service.

9. Apadmi

| Location | Employee Count |

|---|---|

| Manchester, UK | 201–500 |

Apadmi is a renowned mobile development house for financial services, delivering innovative, secure, and compliant apps to banks, insurance, and wealth platforms. They excel at crafting user-centric experiences, from onboarding to payment solutions

Why Apadmi?

Apadmi’s value lies in their focus on mobile-first engagement, robust security/IP, and data-driven UX. These factors make them ideal for financial brands who want to differentiate through best-in-class mobile products and swift, award-winning digital transformation.

10. PowerGate Software

| Location | Employee Count |

|---|---|

| Hanoi, Vietnam | 201–500 |

PowerGate Software is a global software product studio specializing in FinTech development for banking and finance. They have 200+ successful projects delivered across multiple continents. They provide custom solutions in digital payments, open banking, and blockchain for start-ups and enterprises.

Why PowerGate Software?

What sets PowerGate apart is their cost-effective engagement models, flexibility for offshore and hybrid deployments, and proven ability to leverage APAC and Western development hubs. That makes them a strategic choice for global FinTechs seeking quality, scalability, and tech capabilities.

How to Choose the Right FinTech Development Partner

You’ve seen the top financial technology companies in 2026. Now comes the real question: which one’s right for you? Forget the flashy pitch decks. What really matters is how a partner handles compliance, scale, and collaboration when it counts.

Here’s a quick checklist to help you dig deeper:

Built-In Compliance

A reliable FinTech development company won't consider compliance as an extra headache. They'll understand its important - for you and the end users - and will build it in right from the start. Some might even have scripts and modules for PCI DSS, GDPR, or AML ready to use.

Also check what technologies are used for FinTech software development. A stronger check stack helps ensure both performance and compliance.

Security That Shows

With the right development team, security won't be an afterthought. Also, good partners won't stop at telling you they've got security covered. Instead, they'd have live dashboards or reports with metrics like MTTD, MTTR, and vulnerability counts ready for you.

Stress-Tested Systems

Enterprise FinTech development companies build systems that will scale and not stagnate. They'll have a plan to handle 5× or 10× traffic spikes and reduce downtime.

A recent digital mortgage software we developed for a client, for example, saw a 70% reduction in downtime with the use of AWS cloud services.

Hands-On Domain Know-How

Ask for real demos, not slides. Can they configure FIX sessions or parse ISO 20022 messages on the fly? Reliable partners will have real industry knowledge that helps them tackle the unique challenges of software development in the FinTech industry.

Start with a Pilot

Security, scalability and compliance are all easier said than done. That’s why, it is important to see the work of a development partner before you dive in for the long-term. For that, you can run a 4–6 week MVP, say, a KYC module or embedded payment feature. It’s the smartest way to evaluate fit.

At Radixweb, we offer specialized MVP development services that can help you assess our processes and explore product-market fit. Once satisfied, you can scale in the right direction.

Important: FinTech Software Development Costs

The cost of developing a FinTech application can vary widely. It all depends on the complexity, features, platform, and regulatory requirements. On average, small apps may start around $50,000–$100,000 and mid-sized platforms can range from $100,000–$500,000. Large, enterprise-grade solutions often exceed $500,000.

While cost is important, make sure it is not the only factor you consider in choosing a development partner. Instead, focus on the value that a partner brings because that has a far greater impact on your product’s success than the initial cost.

Getting Started with FinTech Software DevelopmentChoosing the right FinTech partner isn’t just about features. It’s about trust, compliance clarity, and execution strength. Make sure you partner with a team that understands the stakes.At Radixweb, we’ve helped build and scale FinTech products across banking, lending, mortage and digital finance. We go beyond code. As a FinTech software development company, we bring regulatory insight, domain experience, and tech strategy to every engagement.Curious to see how we can support your vision? Book a free consult with our team of top FinTech software developers in 2026 to unpack your goals, compliance needs, and product roadmap. We are ready to help you move forward with clarity.

FAQs

Which FinTech software companies specialize in enterprise-level solutions?

How do I evaluate the credibility of a software development company?

What’s the typical engagement model for top FinTech software development firms?

Do financial software development firms provide end-to-end product development or just coding?

Are these FinTech software outsourcing companies region-specific or do they serve global clients?

Ready to brush up on something new? We've got more to read right this way.