Read More

Discover what’s next for AI in healthcare in 2026 - Get Access to the Full Report

ON THIS PAGE

ON THIS PAGE

Summary: Artificial Intelligence (AI) is redefining the financial services industry. In this article, we explore what AI in FinTech means, how it has evolved, its benefits, real-world use cases, challenges, and a practical blueprint to implement AI in the FinTech industry. We also share insights from our years of experience at Radixweb, helping organizations turn AI ambition into real, measurable value.

Financial technology (FinTech) has grown from a niche sector to a market that will be worth USD 1.5 trillion by 2030.

Traditional banks, neobanks, payment service providers, and insurance companies are all using technology to streamline operations, bring down costs, and provide better experiences for their customers.

At the same time, AI has emerged as one of the most transformative technologies being used in finance. From detecting fraud and assessing credit risk to automating customer service and predicting market trends, it is reshaping how financial institutions operate.

But despite the hype around AI and FinTech, a lot of organizations struggle to implement it effectively.

In this article, we attempt to share a clear, practical perspective on AI in the FinTech industry. We will cover everything from what is FinTech and what is AI to how the two have evolved, the benefits, challenges, use cases, and implementation guide.

What is AI in FinTech?

Artificial intelligence, at its simplest, is the capability of machines to mimic human intelligence. By 2030, the market will reach $1,811.8 billion in valuation.

AI for financial services involves algorithms that can learn from data, recognize patterns, and make decisions.

Artificial intelligence and FinTech are not futuristic concepts anymore. They are becoming a core capability for any financial organization aiming to remain competitive. Understanding its components, applications, and potential is the first step toward building a practical strategy for using AI for financial services. Let’s start by understanding the key AI technologies that are used in FinTech.

Some of these technologies include:

Machine Learning (ML)

Algorithms analyze historical and real-time data to identify patterns. This is useful for fraud detection, credit scoring, and investment recommendations.

Natural Language Processing (NLP)

Enables machines to understand, interpret, and respond to human language. In FinTech, NLP powers chatbots, automated customer support, and document analysis.

Robotic Process Automation (RPA)

Automates repetitive, rule-based tasks such as data entry, reconciliation, and reporting.

Predictive Analytics

Uses historical and real-time data to forecast future trends, helping financial institutions make informed decisions.

Overall, the use of AI programming languages allows organizations to process vast amounts of data at speed, reduce errors, identify opportunities or risks earlier, and deliver a more personalized experience to customers.

How AI in FinTech Has Evolved Over the Years?

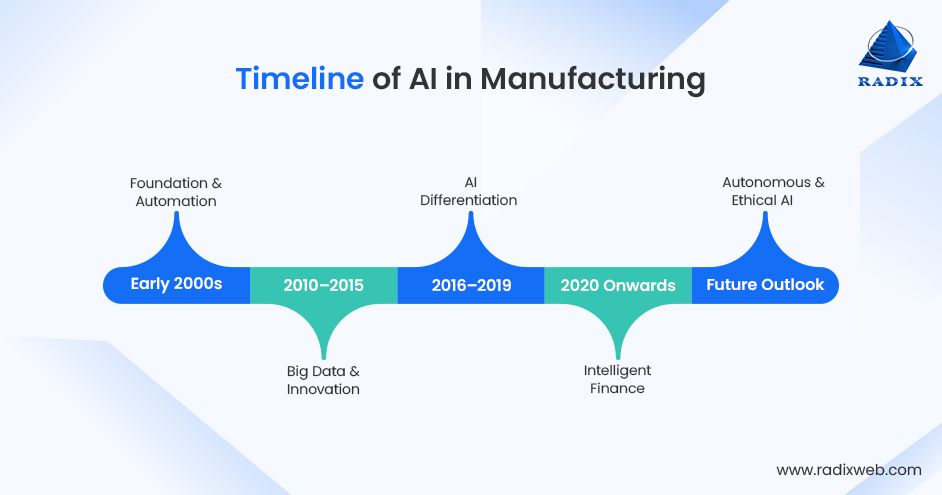

The story of AI in FinTech isn’t one of sudden transformation, but of steady evolution. Each decade brought its own wave of breakthroughs, starting from rule-based automation to the sophisticated, self-learning systems we see today.

Here’s how the journey unfolded:

Early 2000s: The Foundation Years

- Banks began experimenting with basic data-driven models for credit scoring.

- Rule-based systems automated repetitive tasks like reconciliation and reporting.

- Predictive analytics appeared in early trading and risk management tools.

- Financial software incorporated basic algorithms to support decision-making.

2010–2015: The Rise of FinTech Startups and Big Data

- Smartphone adoption and open APIs spurred rapid FinTech innovation.

- Machine learning started improving fraud detection accuracy.

- AI chatbots provided round-the-clock support in online banking.

- Robo-advisors like Betterment and Wealthfront brought algorithmic investing to consumers.

- Startups used alternative data sources to widen credit accessibility.

2016–2019: AI as a Competitive Differentiator

- Financial institutions began adopting AI for personalized products and experiences.

- NLP tools automated compliance checks and document review.

- Predictive models powered smarter portfolios and risk management decisions became a top FinTech trend.

- Real-time fraud detection systems became more accurate and adaptive.

- AI-driven process automation improved underwriting and claims handling.

2020 Onwards: The Era of Intelligent Finance

- Digital banking surged, with AI at the core of customer engagement.

- ML-powered credit scoring enabled faster and fairer lending decisions.

- Generative AI began assisting analysts in reporting and compliance tasks.

- Predictive analytics supported proactive customer retention and cross-selling.

- AI-powered AML systems reduced false positives and compliance costs.

- Explainable AI became one of the top AI in FinTech trends and also helped organizations meet new regulatory standards.

Future Outlook: Towards Autonomous and Ethical Finance

- AI agents will manage full financial workflows with minimal oversight.

- Generative AI will design and personalize financial products on demand.

- Quantum AI will unlock real-time market modeling and predictive accuracy.

- Ethical and transparent AI frameworks will shape global financial regulation.

- Human-AI collaboration will redefine advisory, lending, and investment roles.

Through our work at Radixweb, we’ve observed that organizations adopting AI and machine learning in FinTech gradually, starting with pilot projects and scaling successful implementations, achieve much higher returns than those attempting large-scale deployments without proper planning.

Take for example, a debt collection software we built for a client with over 12,000 clients across the globe. With timely prototyping and iterations, they saw a 55% increase in productivity with their debt collection software.

What are the Benefits of AI in FinTech?

AI brings several tangible advantages to FinTech, impacting both internal operations and customer experiences. The top benefits of AI in FinTech:

1. Fraud Detection & Risk Management

Fraud and financial crime are among the top concerns for financial institutions. AI can analyze millions of transactions in real-time, identify patterns, and flag suspicious activities that may otherwise go unnoticed by humans. By combining predictive modeling with historical data, AI reduces false positives and enables faster intervention.

2. Improved Customer Experience

When technology solutions first became mainstream, improved customer experience was the first tangible impact of FinTech in banking. Today, the customers have come to expect fast, personalized, and seamless interactions. To facilitate that, AI powers chatbots that respond to queries instantly, provide recommendations tailored to individual financial behaviors, and predict customer needs before they arise. This creates a more engaging experience while reducing strain on support teams.

3. Operational Efficiency & Cost Reduction

AI automates repetitive tasks, reduces manual effort, and speeds up decision-making. From reconciling accounts to loan management, AI frees employees to focus on higher-value work. Organizations often see a measurable reduction in operational costs and an increase in accuracy.

4. Better Decision-Making

AI API development helps financial organizations make data-driven decisions. Predictive analytics, for example, can forecast market trends, identify investment opportunities, or assess credit risk with higher accuracy. AI-driven insights support smarter, faster, and more confident decision-making.

5. Regulatory Compliance

Financial institutions operate in a highly regulated environment. The use of AI in financial technology assists in monitoring compliance requirements, generating audit-ready reports, and identifying potential risks before they escalate. This reduces regulatory risk while ensuring operational efficiency.

These benefits highlight that AI is an organizational shift and it is one of the technologies that are shaping the future of finance.

What are some Real-World Use Case of AI in FinTech?

AI is no longer a futuristic promise in FinTech. Today, AI applications in FinTech are quietly reshaping how financial systems think, decide, and respond in real time. From fraud detection to smarter lending, institutions are learning that AI-based FinTech isn’t just about automation but also about precision, personalization, and scaling trust in digital finance.

Here are a few real-world AI in FinTech use cases that stand out:

1. AI-Powered Credit Scoring and Loan Underwriting

Traditional credit scoring systems often overlook individuals with limited financial histories. This left millions unbanked or underserved. AI-driven credit models change this by evaluating a wider range of data like:

- Income stability

- Spending habits

- Behavioral and digital footprints

This makes it more inclusive and accurate about lending decisions. These models continuously learn from repayment behavior, adjusting risk scores over time, and improving portfolio quality for lenders. Upstart, for example, which is a lending platform, uses machine learning to analyze over 1,600 data points per applicant, which is far beyond a typical credit score. The result was faster approvals, lower default rates, and broader access to affordable credit, especially borrowers who might otherwise be overlooked by traditional banks.

2. Fraud Detection and Risk Management

Financial fraud is evolving as fast as the technology that combats it. Fraud detection systems that monitor millions of transactions per second and identify anomalies that traditional rule-based systems can’t are among the best AI use cases today.

These models analyze user behavior, transaction context, and network connections to detect suspicious activities in real time. The result is that organizations can respond proactively instead of reactively. Stripe’s platform, Radar, for example, uses AI that is trained on data from millions of global businesses to flag fraudulent transactions before they occur. It has helped reduce fraud losses by 42%, while improving legitimate transaction approvals and enabling merchants to grow without compromising on security.

3. AI in Regulatory Compliance and Anti–Money Laundering (AML)

Compliance has long been one of the most complex and resource-intensive areas in finance. AI simplifies this by automating pattern recognition in massive data streams, identifying irregularities that could signal money laundering or policy violations. Natural language processing (NLP) models can also parse through legal contracts and reports, ensuring institutions remain audit-ready with less manual work.

JPMorgan Chase, for example, employs AI across its compliance workflows like monitoring transaction networks for AML and automating document review in its “COiN” platform. The result has been a dramatic reduction in false positives and over 360,000 hours saved annually in manual contract analysis.

4. Intelligent Fraud Prevention in Digital Payments

In the fast-moving world of mobile payments and eCommerce, fraudsters constantly test new tactics. AI-enabled systems that can analyze relationships between accounts, devices, and behaviors have become vital. These models can flag unusual transaction sequences or suspicious account linkages in milliseconds, which is impossible for human teams to manage manually at scale. Ant Group (formerly Ant Financial), which powers the Alipay ecosystem, uses AI and graph-based machine learning to detect fraudulent behavior across billions of real-time transactions. This approach has significantly reduced fraud incidents while keeping user experience frictionless, which is a balance that’s critical in consumer-facing digital finance.

5. Personalized Customer Experience and Financial Advisory

AI is transforming how financial institutions engage with customers. Intelligent assistants, chatbots, and recommendation engines now help users make smarter decisions about savings, insurance, and investments. These systems learn from customer interactions and financial behaviors, offering advice tailored to individual goals, which are essentially creating a digital financial concierge. Bank of America’s virtual assistant, Erica, is a great example of this. Erica has interacted with over 3 billion customers, providing proactive spending insights, reminders, and personalized financial advice. Beyond convenience, Erica’s AI-driven recommendations have improved financial literacy and customer satisfaction, which is often an important differentiator in the competitive banking sector.

The Bigger Picture

These are just a handful of the most visible FinTech AI use cases, but the horizon is much broader. AI is also driving innovation in algorithmic trading, insurance claim automation, wealth management robo-advisors, and risk modeling for complex portfolios. As AI models become more explainable and real-time data pipelines mature, new applications are emerging almost monthly.

At Radixweb, we’ve seen firsthand how implementing AI and machine learning in FinTech requires a fine balance between deep domain understanding, robust data governance, and the right technical foundation. Done right, the use of AI in FinTech will usher in an era of rethinking how trust, intelligence, and finance intersect in the digital age.

What are the Key Challenges of Using AI in FinTech?

Despite the benefits, implementing AI in FinTech is not without its own challenges. Organizations must navigate several potential pitfalls, including:

1. Data Privacy & Security

Financial data is highly sensitive. Any AI system must ensure data is securely stored, processed, and compliant with regulations like GDPR or CCPA.

2. Bias in AI Models

If AI models are trained on incomplete or biased datasets, they can unintentionally perpetuate discrimination in credit scoring, lending, or hiring decisions. Regular audits and diverse data sources are critical for the proper use of AI in the FinTech industry.

3. Integration with Legacy Systems

Many banks operate with legacy software that wasn’t built for modern, AI-based FinTech solutions. Integrating AI requires careful planning, data standardization, and sometimes partial system upgrades.

4. Change Management

Using AI for financial services often changes workflows and employee responsibilities. Staff need training to understand AI outputs and collaborate effectively with AI tools.

5. Regulatory Compliance

When building AI software solutions, it is important to ensure that they align with strict financial regulations. Organizations need transparent models that can be audited, explained, and defended.

Understanding these challenges upfront and planning for them is essential. Our experience shows that addressing them early, right during the AI consulting phase, prevents costly delays and ensures AI adoption is sustainable.

How to Implement AI in FinTech: A Step-by-Step Implementation Guide

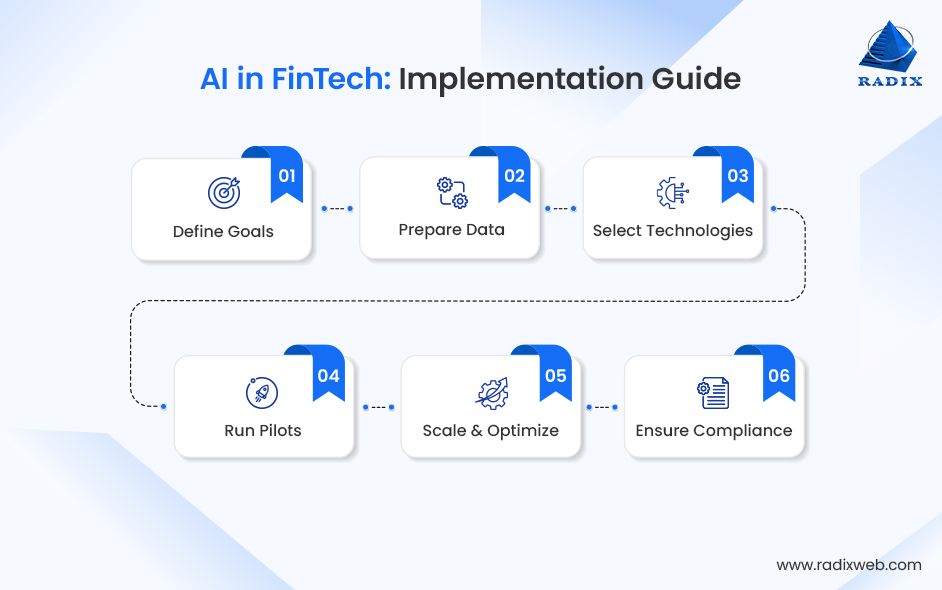

Implementing AI financial technology successfully requires a structured approach. Here’s a practical roadmap we follow at Radixweb:

Step 1: Identify Business Goals

Start by defining what you want AI to achieve. Common goals include fraud detection, customer engagement, or cost reduction. Clear objectives for AI for FinTech help in selecting the right technologies.

The first step is to identify your AI in FinTech use case. Decide what you want your AI to achieve. Some common goals include fraud detection, customer engagement, and cost reduction.

By setting clear objectives for your AI project, you can pave the way for selecting the right tech stack and the right AI development partner

Step 2: Collect and Prepare Data

High-quality data is the foundation of AI in FinTech. Collect historical and real-time data, clean and structure it, and ensure it is representative of the scenarios you want to address.

Step 3: Choose AI Technologies

Select tools and platforms aligned with your goals. Machine learning frameworks, NLP engines, RPA software, or cloud AI platforms are all useful for different types of AI in FinTech projects. Technology choice should balance capability, scalability, and integration ease.

Step 4: Pilot Projects

Develop small-scale pilots with dependable FinTech AI solution providers to test assumptions and validate AI models. Focus on measurable outcomes to determine feasibility before scaling.

Step 5: Scale & Optimize

Successful pilots should be carefully scaled across the organization. From developing AI software to developing AI agents, continuous monitoring is essential in every project to ensure models remain accurate and efficient. Also, ongoing adjustments should be made based on performance.

Step 6: Ensure Compliance & Governance

Maintain oversight of AI models, document processes, and ensure regulatory adherence. Governance frameworks reduce risk and increase stakeholder trust.

By following this structured approach to FinTech software development, organizations can move beyond experimentation to AI solutions that provide real, sustainable value.

Getting Started with AI in FinTechEvery day you delay AI adoption, your competitors move one step closer to defining the future of FinTech. To maintain race pace and clinch the AI advantage, you need to quickly zero in on an AI use case and then hire FinTech developers or work with FinTech solution providers to get the idea off the ground.At Radixweb, we’ve worked with clients to turn AI in FinTech from a concept into a core capability. The key is focusing on value, not novelty.We help organizations:● Identify opportunities to use AI for FinTech and align those with strategic goals.● Build solutions that integrate with existing operations and systems.● Measure and optimize outcomes to ensure AI drives tangible improvements.AI in FinTech is no longer optional. But successful adoption requires planning, clear objectives, and a focus on practical value. By approaching AI thoughtfully and mapping your journey with the future of AI in FinTech, organizations can reduce risk, enhance operations, and deliver better experiences for customers.If you’re interested in exploring how AI can transform your financial operations, you can schedule a no-cost strategy session with Radixweb experts to discuss opportunities tailored to your goals.

Frequently Asked Questions

How does AI help in FinTech fraud detection?

How can AI improve customer experience in FinTech?

How does AI reduce operational costs in FinTech?

How does AI support regulatory compliance in FinTech?

Ready to brush up on something new? We've got more to read right this way.