Read More

Discover what’s next for AI in healthcare in 2026 - Get Access to the Full Report

On this page

- Application Modernization Services Market Statistics

- Application Modernization Tools Market Statistics

- Identifying and Avoiding Risks of Traditional App Modernization

- Global Application Modernization Services Market – By Regional

- Application Modernization Services Market Analysis – By End-User Industry

- Impact of AI in Application Modernization

- Top Companies Market Share in Application Modernization Tools Industry

- Stay On Top of What's Next in Technology with App Modernization

On this page

- Application Modernization Services Market Statistics

- Application Modernization Tools Market Statistics

- Identifying and Avoiding Risks of Traditional App Modernization

- Global Application Modernization Services Market – By Regional

- Application Modernization Services Market Analysis – By End-User Industry

- Impact of AI in Application Modernization

- Top Companies Market Share in Application Modernization Tools Industry

- Stay On Top of What's Next in Technology with App Modernization

Quick Overview: Discover key statistics on application modernization trends: Cloud and DevOps integration drives growth, with SMEs adopting services for scalability. The facts and research presented in the application modernization services market statistics aim to provide valuable data, insights, and benefits to stakeholders, vendors, and other industry participants.

Ever wonder what’s really holding modern businesses back from scaling fast? For many executives, the answer is the same: Legacy Applications. These systems simply can’t keep up with market trends and needs.

And the market data backs this urgency: the application modernization industry is projected to hit USD 24.8 billion by 2029, growing at a strong 16.7% CAGR. Well, that’s not just growth, it’s a signal that companies everywhere are racing to upgrade.

Application modernization today is no longer just about “fixing old software.” It’s about giving your business a competitive advantage through smarter architecture, cloud adoption, and AI-powered transformation. From automated code refactoring to intelligent migration planning, AI is changing how leaders approach modernization altogether.

In this digital world, application modernization emerges as the guiding beacon for organizations who want to upgrade their applications for better performance.

Step into a world where facts and data speak volumes, and numbers tell tales of resilience and adaptation. This article, Application Modernization Statistics, is not just a collection of statistics but also data and challenges faced by organizations planning to embrace the future.

Join us on this interesting journey of facts, where every statistic is a stepping stone towards innovation, numbers come alive, and the future awaits.

Application Modernization Services Market Statistics

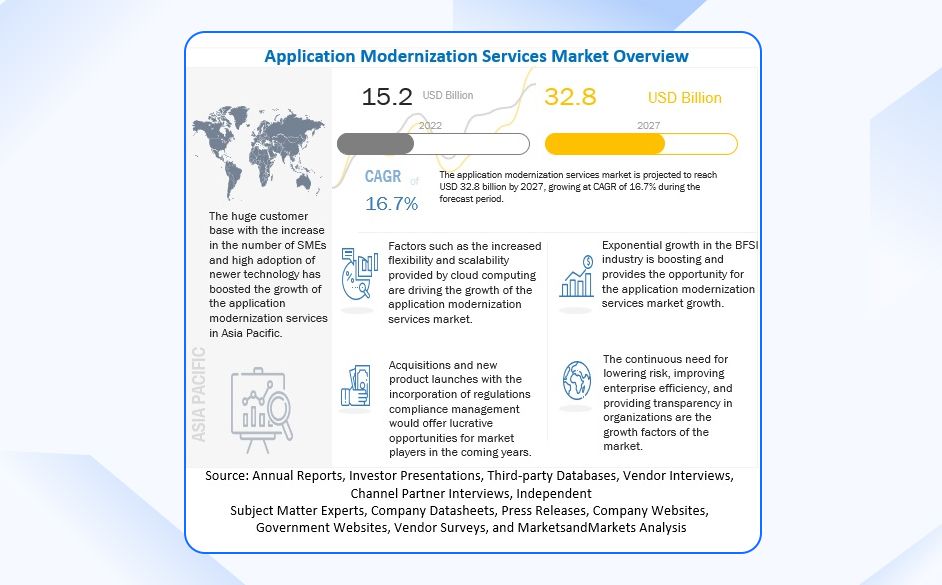

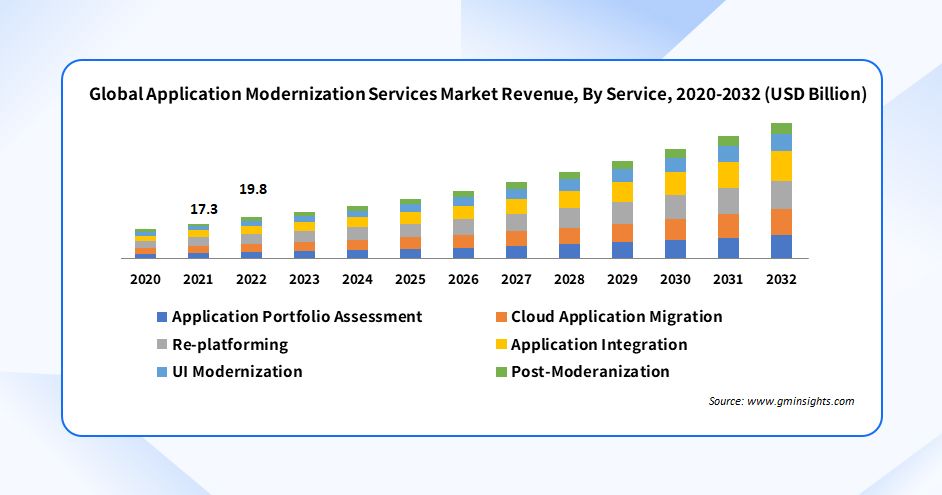

The increased growth of application modernization services is driven by increased adoption of cloud technology and DevOps integration to enhance software functionality. Moreover, increased government support in promoting the adoption of application modernization services acts as an additional catalyst for market growth within this sector.

- According to a recent survey, 87% of business leaders said modernization is essential to grow and succeed in a business.

- The report states that the application modernization services market globally was valued at $15.5 billion in 2022. It’s expected to reach $69.8 billion by 2032, growing at a CAGR of 16.5% from 2023 to 2032.

- Foundry’s State of The CIO Study 2023 reported that application modernization is the third-highest initiative for CIOs. In 2025, modernizing their existing applications and remaining reinvention ready still remains among a CIO’s top 10 priorities. Around 91% of CIOs expect their budgets to increase for modernization to boost their business agility.

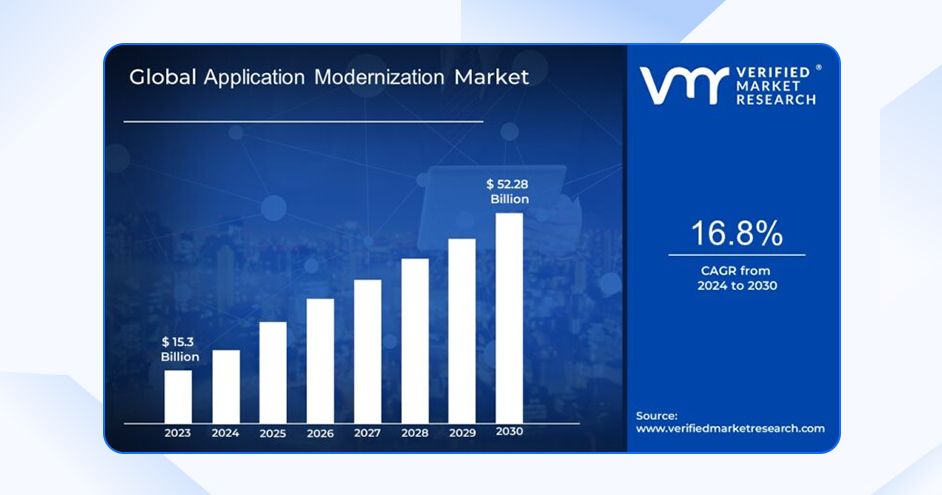

- Application modernization market is expected to increase at a CAGR of 16.8% from 2024 to 2030, from its estimated value of USD 15.3 billion in 2023 to USD 52.28 billion by 2030.

- Over the course of the forecast period, the application modernization services market is anticipated to develop at a Compound Annual Growth Rate (CAGR) of 16.7%, from USD 15.2 billion in 2022 to USD 32.8 billion by 2027.

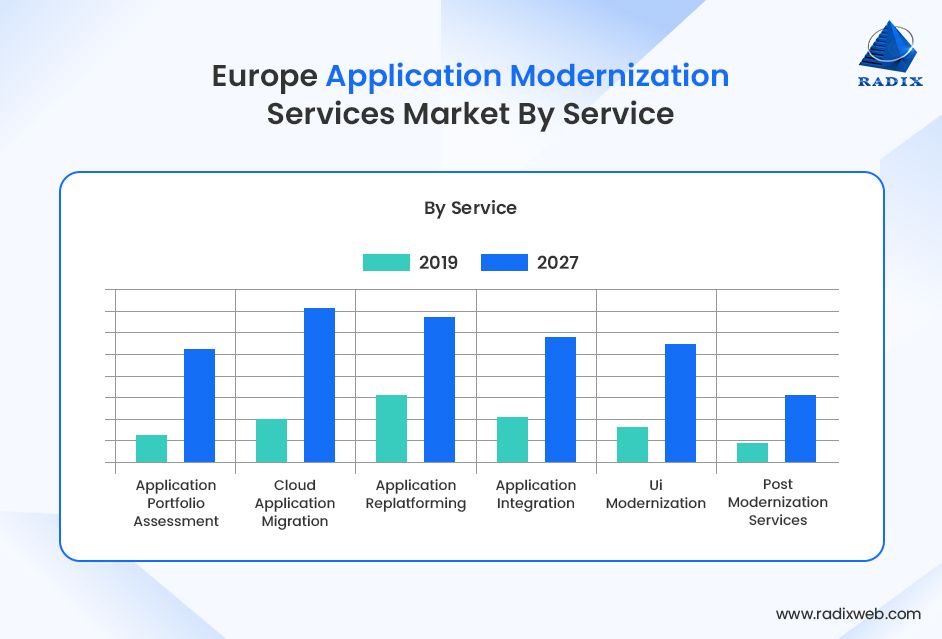

- The market for application modernization services in Europe was estimated to be worth $2.14 billion in 2019 and is expected to increase at a compound annual growth rate (CAGR) of 15.1% from 2020 to 2027, reaching $6.60 billion.

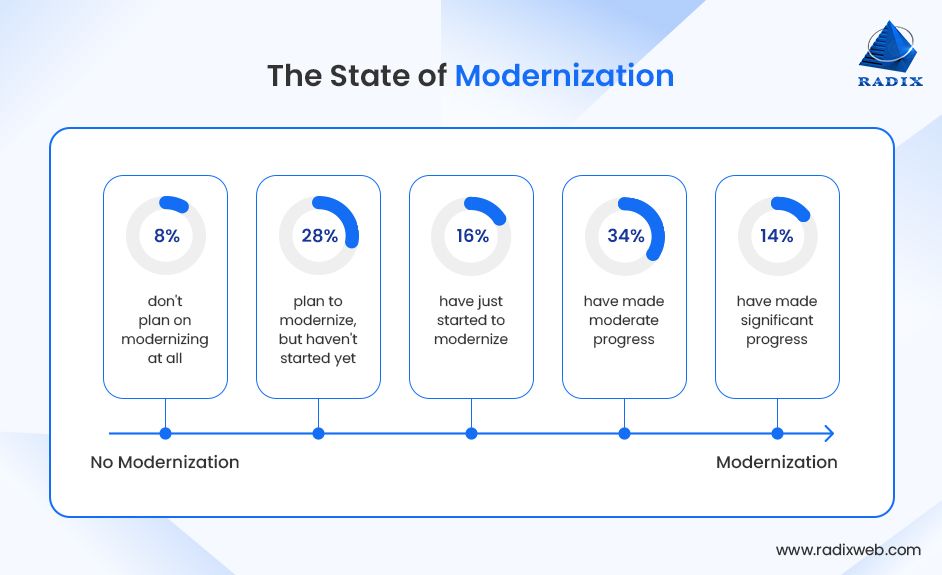

- Nearly two-thirds of businesses (65%) stated that their digital transformation process is "in-progress." By comparison, 57% of respondents thought they were "at a similar place relative to their peers." 53% of respondents say they have a "system in place to coordinate cross-functional modernization activities," meaning they have digital projects that go beyond just one business division.

- Public cloud now hosts 38% of all workloads on average for enterprises, more than private cloud (35%) and on-premises data centers or colocation (27%). This division holds true for all business sizes and industry verticals.

- Merely 6% of respondents indicated that they were not upgrading any applications whatsoever. In contrast, according to 71% of the surveyed organizations, at least one out of every four apps are being modernized, and 24% are modernizing half or more of them. The importance of modernization is evident, with enterprise software such as CRM/ERP leading the way.

- 90% of those surveyed said that application’s value to their industry or business had increased during the previous five years. Application modernization helped grow their businesses in every manner.

- According to a recent survey, 92% of businesses claim to be actively working on at least one app modernization project by choosing the right strategy for their legacy applications. Four in five respondents (79%) in the survey also admitted they had experienced an app modernization failure.

- According to Gartner, by 2027, 75% of enterprises will adopt AI-assisted application modernization tools, dramatically reducing manual code analysis and migration timelines.

- McKinsey reports that companies using AI-driven modernization accelerate transformation 30–50% faster than traditional approaches.

- IDC predicts that 40% of all application modernization initiatives in 2025 will be powered by GenAI, particularly for automated code refactoring and dependency mapping.

- Flexera’s 2025 State of the Cloud report shows that 33% of enterprises are spending more than $12 million annually on public cloud services.

- As per data from Accenture, organizations that modernize early experience a 5x reduction in technical debt accumulation compared to laggards.

- Deloitte’s survey highlights that 61% of CIOs cite AI and cloud-native architectures as the top two drivers of modernization roadmaps for 2025–2026.

- MarketsandMarkets reports that AI-powered cloud modernization will create $11.2 billion in new market opportunities by 2028.

Application Modernization Tools Market Overview

- According to Cognitive Market Research, the global application modernization tools market is expected to reach a value of USD 8951.2 million in 2023 and increase at a CAGR of 19.20% between 2023 and 2030.

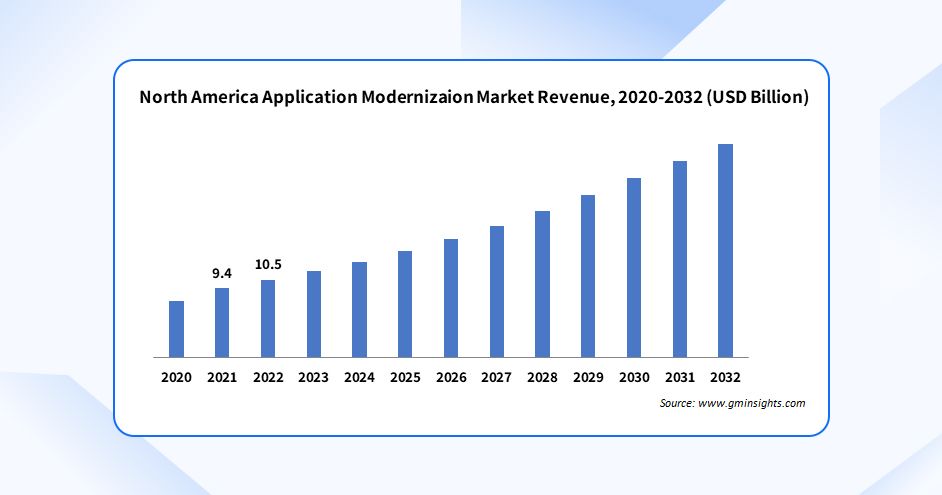

- With a market size of USD 3580.48 billion in 2023 and projected to expand at a CAGR of 17.4% from 2023 to 2030, North America accounted for more than 40% of worldwide revenue.

- With a market size of USD 2685.36 billion in 2023 and projected to expand at a CAGR of 17.7% from 2023 to 2030, the Europe market accounts for more than 30% of worldwide revenue.

- At USD 2058.78 billion in 2023, Asia Pacific accounted for the fastest-growing market, with over 23% of worldwide sales. From 2023 to 2030, the market is expected to develop at a CAGR of 21.2%.

- With a market size of USD 447.56 billion in 2023 and projected to increase at a compound annual growth rate (CAGR) of 18.6% from 2023 to 2030, Latin America accounts for more than 5% of global sales.

- More than 2.00% of worldwide revenue comes from the Middle East and Africa market, which reached USD 179.02 billion in 2023 and would rise at a compound annual growth rate (CAGR) of 18.9% through 2030.

- A report from Gartner states that by 2030, over 70% of large enterprises will use AI-driven modernization tools, accelerating legacy transformation timelines by up to 40%.

- MarketsandMarkets, the application modernization services market is estimated to be worth USD 22.67 billion in 2025 and is projected to reach USD 51.45 billion by 2031, growing at a compound annual growth rate (CAGR) of 14.6%.

- IDC project worldwide spending on technology to support AI will reach $337 billion in 2025.

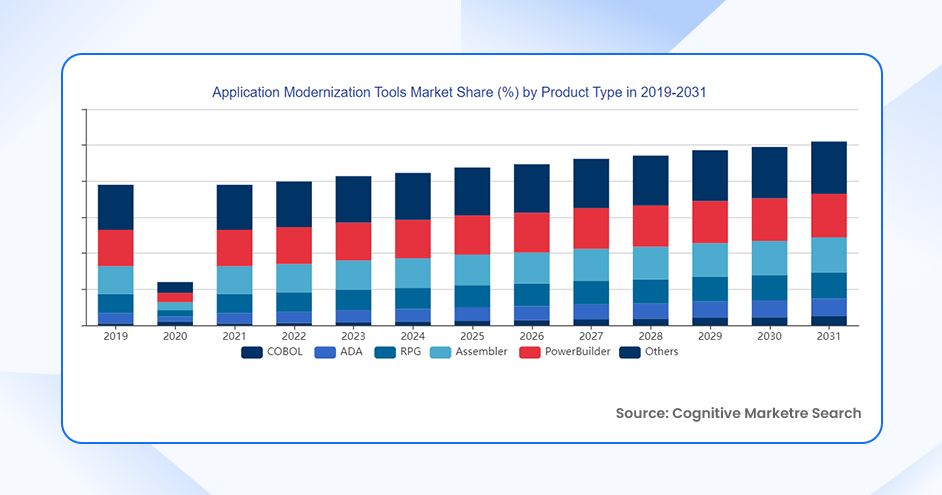

Application Modernization Tools Market Analysis – By Product Segment

According to Cognitive Market Research, COBOL dominates the application modernization tools market. The reason for this dominance is the widespread use of legacy COBOL-based systems across many industries, most notably major companies, government, and finance.

COBOL-specific application modernization tools remain essential for enabling migration, re-engineering, and transformation into microservices, Java, .NET, or cloud-native architectures.

PowerBuilder emerges as the fastest-growing product segment, as many manufacturing, enterprise software, and financial applications built in the 1990s still rely on the platform. These applications now require modernization to align with modern tech standards, UX expectations, cloud environments, and integration ecosystems.

Application Modernization Tools Market Share (%) by Product Type

- COBOL

- ADA

- RPG

- Assembler

- PowerBuilder

- Others

- A 2024 Micro Focus study revealed that over 800 billion lines of COBOL code are still in active use globally—an increase from prior estimates. This makes COBOL modernization tools one of the most mission-critical categories.

- Flexera’s 2024 report showed 61% of enterprises still maintain at least one PowerBuilder-based critical application, fueling demand for migration and refactoring tools.

With AI integrating into almost every development project in 2025 and beyond, the need for such modernization tools that help layer in AI with existing systems is expected to rise further.

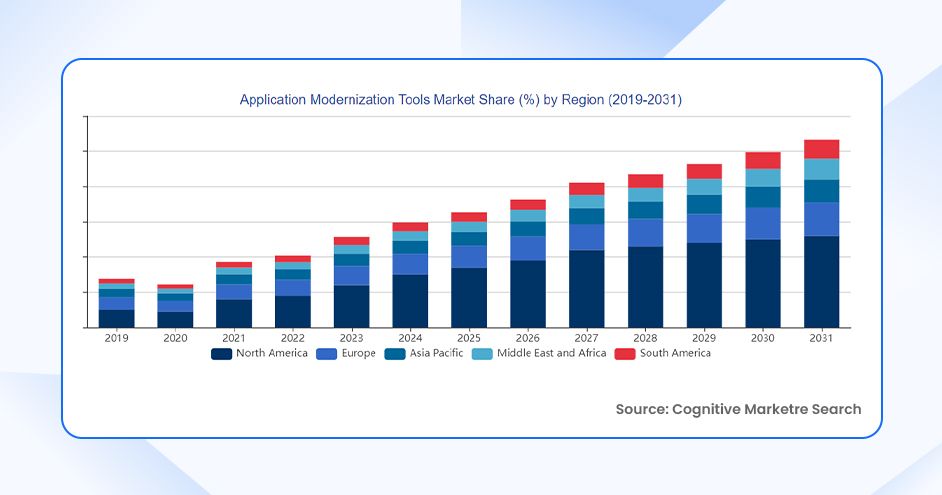

Application Modernization Tools Market Analysis – By Region

The entire segment is segregated into five major regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

North America (United States, Canada, Mexico)

The largest market due to heavy adoption of cloud-native modernization, government digital transformation initiatives, and major enterprise reliance on mainframe systems.

Europe (United Kingdom, France, Germany, Italy, Russia, Spain, Sweden, Denmark, Netherlands, Switzerland, Belgium)

High modernization demand in BFSI, public sector, and manufacturing is driving continuous investment.

Asia-Pacific (China, Japan, Korea, India, Australia, Philippines, Singapore, Malaysia, Thailand, Indonesia, Rest of APAC)

The fastest-growing region due to rapid cloud migration, digital-first government policies, and expansion of enterprise tech landscapes.

South America (Brazil, Argentina, Colombia, Peru, Chile, Rest of South America)

Steady adoption of modernization tools driven by enterprise cloud acceleration and system consolidation.

Middle East and Africa (Saudi Arabia, Turkey, Nigeria, UAE, Egypt, South Africa, GCC Countries, Rest of MEA)

Growth fueled by national digital transformation programs and large-scale public-sector modernization.

Middle East enterprise modernization initiatives, especially in UAE and Saudi Arabia, are expected to grow 28% faster than the global average by 2027.

APAC’s modernization spend is estimated to surpass Europe by 2028, driven by hyperscaler expansion and accelerated cloud mandates.

Top Companies in the Application Modernization Tools Market

Key players include:

- Asysco

- Micro Focus

- Mapador

- Fresche Legacy

- Raincode

- Metaware

- Semantic Designs

- Expersolve

- Anubex

- MOST Technologies

Gartner’s 2025 analysis also ranks EvolveWare as a Representative Vendors in Mainframe and Legacy Systems Migration and Modernization Tools.

Several companies (Semantic Designs, Modern Systems, Anubex) have integrated GenAI refactoring engines, reducing analysis and code conversion time by up to 45%.

Identifying and Avoiding Risks of Traditional App Modernization

Identifying and avoiding risks associated with traditional application modernization requires careful assessment of legacy systems, potential disruptions to business operations, and impactful strategies to minimize downtime and data loss.

Complicated and Time-Consuming: According to more than half (58%) of software and architectural leaders, the average app modernization effort takes 16 months per project. Over 25% of respondents believe these undertakings take two years or longer.

Gartner’s survey shows that nearly 65% of modernization delays occur due to undocumented dependencies, making discovery and code analysis one of the most time-consuming phases.

Why most projects fail here:

- Legacy systems often include hidden dependencies undocumented for 10–20+ years.

- Teams underestimate the effort required for code analysis, testing, and compatibility fixes.

- Skills required to understand old programming languages (COBOL, RPG, PowerBuilder, Assembler) are increasingly scarce.

Expensive: Approximately 74% of respondents believe that the average cost of an application modernization project is $1.5 million.

Modernization projects exceed their planned budgets in 52% of cases, primarily due to integration challenges and unexpected legacy system complexities.

Deloitte estimates that organizations can lose up to 23% of their total IT budget annually if they continue delaying modernization due to growing technical debt and infrastructure maintenance costs.

Why most projects fail here:

- Poor initial assessments cause teams to miss hidden systems requiring modernization.

- Overwhelming technical debt inflates rework costs.

- Legacy code often requires manual refactoring, which is labor-intensive and expensive.

Risky: It's not uncommon for app modernization projects to fail. In the poll, around 80% of respondents said they experienced at least one unsuccessful attempt at modernizing an app.

Around 61% of failed modernization initiatives are traced back to poor requirement discovery, while 29% fail due to lack of internal modernization skills.

Forrester found that 42% of companies experienced unexpected outages during modernization—often caused by incomplete testing and data migration errors.

Why most projects fail here:

- Inadequate requirement mapping leads to features being missed or broken after migration.

- Teams lack skilled cloud architects or modernization specialists.

- Organizations skip incremental testing, causing failures in production.

- Legacy data structures cause issues during migration or transformation.

Application Modernization Services Market Analysis

According to MarketsandMarkets, the application integration services market is expected to grow to $6.9 billion by 2027, at a CAGR of 14.1%, driven by the adoption of hybrid cloud and API-first architectures.

By 2026, over 55% of enterprise applications will rely on integration platforms to ensure interoperability in multi-cloud environments.

Through additional investments, companies providing these services are growing their market share. For example, SaaS application integration company Unito Inc. announced in October 2022 that it intends to increase its market share following a $20 million investment round, bringing its total capital received to $32.9 million. The growing incorporation of cloud technology will influence growth in this area.

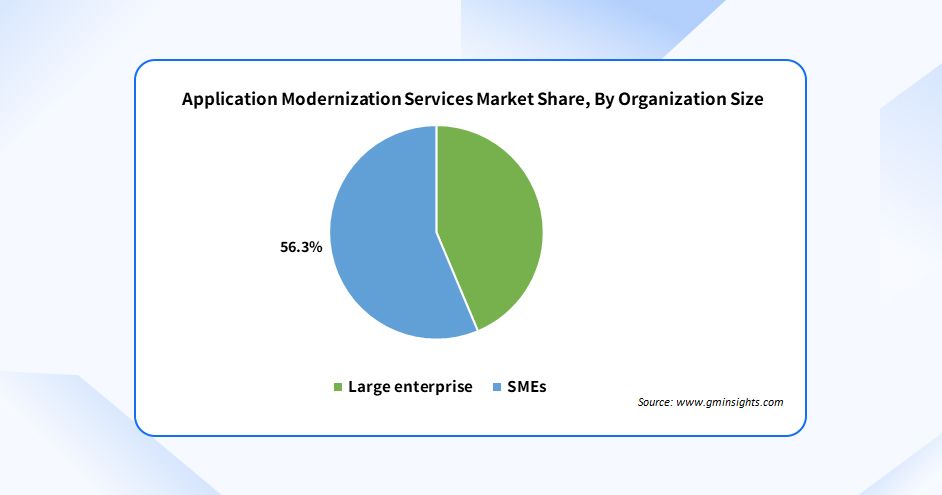

The SMEs segment in the application modernization services market is growing rapidly due to budget constraints and a need for efficiency. SMEs segment will reach over 10% CAGR through 2032. Setting up on-premises data storage infrastructure requires significant investments, which can be challenging for SMEs with limited resources.

In the IT & ITes segment, organizations are adopting cloud-based solutions to enhance security and scalability, driving the market towards USD 10 billion by 2032. Businesses are looking to build application modernization strategies and approaches as a result of the shift to the cloud for apps.

Around 78% of SMEs increased their cloud and modernization spending in the last year, specifically to reduce operational overhead and improve scalability.

46% of SMEs plan to modernize at least half of their legacy applications by 2027, driven by cost pressure and digital competitiveness.

Application Modernization Services Market Share

Some leading companies involved in the application modernization services market are:

- Tech Mahindra Ltd

- Accenture

- IBM Corporation

- TATA Consultancy Services Limited

- Microsoft Corporation

- Infosys Limited

- Nutanix

- Oracle Corporation

- Deloitte

- Dell Inc

- Wipro

- Atos SE

- LTIMindtree Limited

- EPAM Solutions Hub

- HCL Technologies Limited

- Softura, Ernst & Young Global Limited

- Cognizant

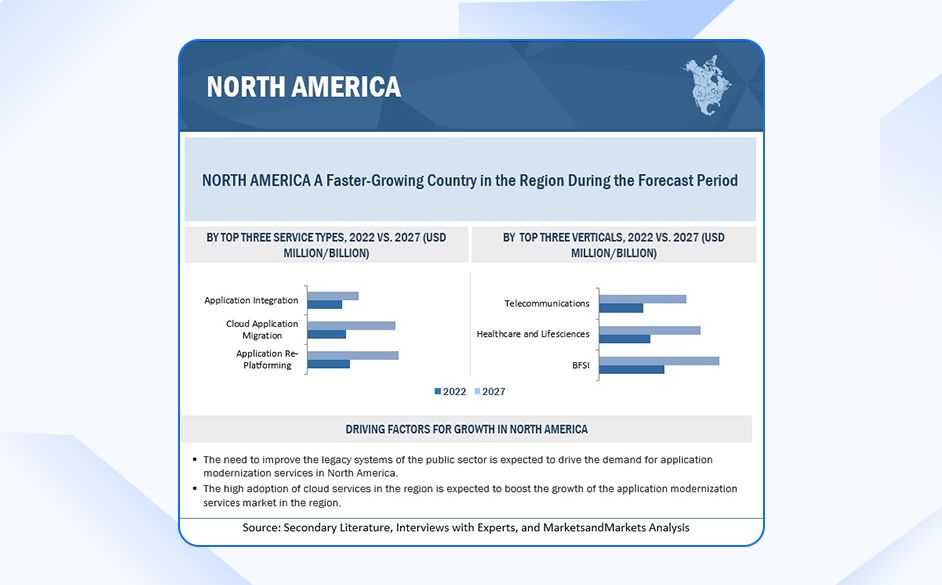

Global Application Modernization Services Market – By Regional

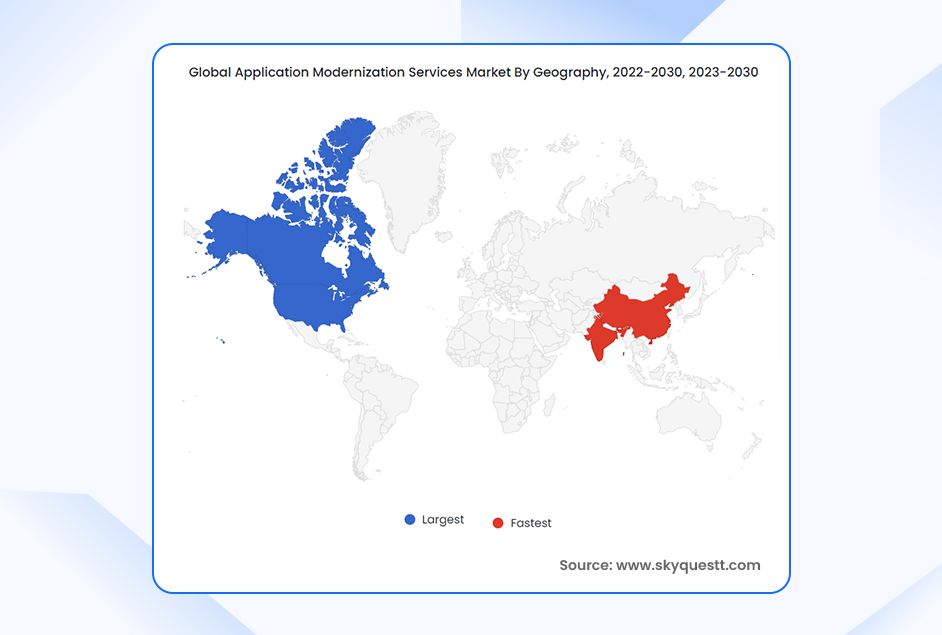

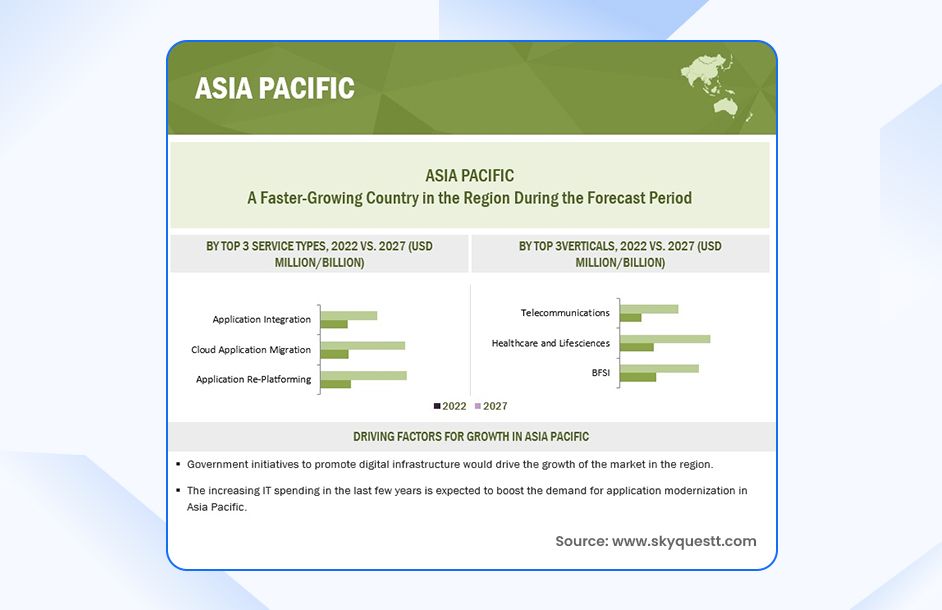

According to IBM, over 70% of APAC organizations are projected to undergo digital transformation by 2030. These factors are expected to drive market share in the forecast period from 2021 to 2026.

The North America application modernization services market is projected to exceed USD 25 billion by 2032, boasting over 50% of the global market share in 2022. Growth is driven by the adoption of cloud-based platforms amidst rising digitalization and technological advancements. Government investments in AI and IoT services further enhance applications, while competition among major players dominates revenue generation.

The Asia Pacific region is poised for significant growth in the application modernization services market, fueled by expanding businesses and substantial government investments in IT infrastructure modernization.

Growing populations and significant technological advancements in countries such as Australia, China, Japan, and India are propelling the Asia-Pacific application modernization industry. These nations are adopting intensive technologies to meet the expanding demand for software services.

During the forecast period, SMEs exhibit the highest CAGR of 21.8%, driven by the widespread adoption of the lift-and-shift migration strategy, facilitating rapid scalability and growth.

In the application modernization services market, the BFSI sector demonstrates the highest CAGR of 22.5%, propelled by the pandemic, which has heightened the demand for digital transformation. An agile and scalable IT environment is imperative to meet evolving customer needs.

Application modernization services companies are fortifying their positions through mergers & acquisitions and sustained investment in research and development (R&D) activities. This strategy aims to devise solutions tailored to the evolving demands of customers.

North America will account for 48% of global modernization spending by 2027, driven by large-scale cloud migration and mainframe transformation projects.

APAC modernization investments will grow at a CAGR of 20.3% through 2030, outpacing Europe due to aggressive digital mandates in China and India.

APAC’s modernization services market will reach USD 18.4 billion by 2028, fueled by hyperscaler expansions (AWS, Azure, GCP) and government-backed cloud adoption programs.

BFSI in APAC will see a 2.4× increase in application modernization spending by 2027 due to real-time payments, cybersecurity regulations, and compliance-driven modernization.

US is Projected to Dominate with the Largest Market Size

Geographically, North America is segmented into US and Canada. With its state-of-the-art IT infrastructure and great technical expertise, the US leads the market share in the region for adopting application modernization.

Moreover, many organizations in America are implementing cloud-based services to make their businesses scalable, flexible, and cost-effective. In fact, companies like Accenture, ATOS, Capgemini, HCL, Cognizant, IBM, and TCS are the main reasons why their decision makers implement application modernization services for enhancement.

The US modernization services market is expected to reach USD 19.7 billion by 2028, with federal agencies increasingly modernizing mission-critical legacy systems.

78% of US enterprises plan to modernize at least 40% of their legacy applications by 2026 (Foundry 2024).

China is Projected to Dominate with the Largest Market Size in Asia Pacific

The Asia Pacific region is divided into some countries, including India, China, Japan, Australia, and the rest of Asia Pacific. Since the economic growth of China is increasing in the Asia-Pacific region, China has had a great impact on developing cloud infrastructure services.

China’s cloud modernization spending is expected to surpass USD 9.5 billion by 2027, driven by the large-scale migration of state-owned enterprises and financial institutions.

Over 67% of Chinese enterprises plan to modernize legacy applications to comply with new security and data residency regulations.

APAC hyperscaler expansion is expected to add over 120 new data centers by 2030, with China leading the growth curve.

Application Modernization Services Market Analysis – By End-User Industry

With the highest CAGR of 22.5%, the BFSI sector in the application modernization services market is growing. The pandemic has increased BFSI's need for digital transformation, with an agile and scalable IT environment required to fulfill their expanding customers’ demands.

Additionally, to transform into an entirely digitally native enterprise and generate new business value from legacy applications, many banking institutes are implementing legacy modernization with new business requirements.

- If we look at the data, 60% of global banks are now modernizing or replacing core banking systems, with API-driven ecosystems expected to increase operational efficiency by up to 45%.

- Moreover, the global BFSI modernization market is projected to reach USD 28 billion by 2028.

- 73% of insurers are modernizing legacy policy administration systems to support automation, omnichannel customer engagement, and AI-driven risk assessment.

Impact of AI in Application Modernization

As we know, AI has stepped into every sector to modernize business operations and functionalities. The report states that the AI market is expected to grow with a CAGR of 36.8% from 2023 to 2030.

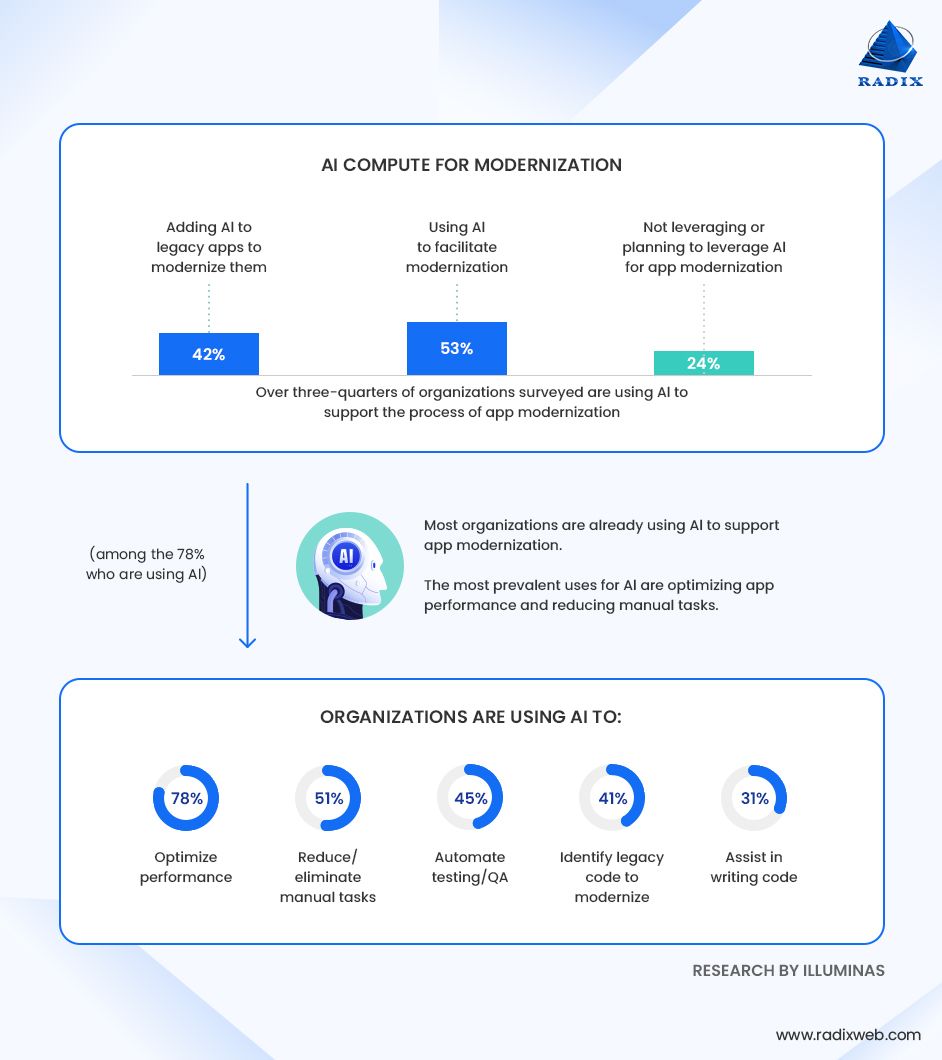

More than 75% of organizations surveyed are leveraging AI to implement application modernization processes. 53% of organizations feel that using AI for app modernization has become very common. 42% are using AI for their legacy application modernization.

AI for App Modernization

- By 2027, over 70% of all modernization projects will use AI-assisted tools for code analysis, documentation generation, and automated refactoring—cutting modernization timelines by up to 50%.

- Organizations using AI for app modernization experience 3× fewer migration errors, thanks to AI-driven dependency discovery and automated validation.

- AI-enabled modernization reduces manual code remediation work by up to 65%, significantly reducing labor costs and accelerating release cycles.

- GenAI-based code transformation improves modernization efficiency by 30–50%, particularly for converting COBOL, PowerBuilder, and RPG applications into cloud-native architectures.

- Around 88% of CIOs plan to increase AI spending specifically for application modernization and cloud migration activities.

- Organizations leveraging AI for modernization achieve 40% faster test coverage, as AI auto-generates test cases and identifies integration defects early.

- By 2028, 40% of modernization tools will include embedded GenAI agents capable of reviewing architecture diagrams, rewriting code, generating APIs, and recommending cloud migration strategies.

- AI-powered modernization platforms can reduce legacy dependency discovery time from several months to under 3 weeks, accelerating the planning phase dramatically.

Why AI Is Transforming Modernization

AI helps organizations modernize faster by:

- Automating code understanding (reverse engineering millions of lines of legacy code)

- Generating modernized code using GenAI models

- Identifying hidden dependencies that traditionally cause project failures

- Accelerating cloud migration with automated mapping and blueprint generation

- Enhancing QA via AI-driven test case creation and regression analysis

- Predicting modernization risks before they impact production

- Reducing costs by minimizing manual refactoring and rework

Top Companies Market Share in Application Modernization Tools Industry

- IBM

- Microsoft (Azure Modernization Tools)

- Amazon Web Services (AWS)

- Google Cloud

- Accenture

- TCS (Tata Consultancy Services)

- Capgemini

- HCLTech

- Wipro

- Infosys

- DXC Technology

Stay On Top of What's Next in Technology with App ModernizationThe picture is very clear here. Application modernization is no longer optional; it’s the defining factor between organizations that scale and those that stall.Businesses of every size and industry are embracing digital transformation by connecting with a app modernization partner and prioritizing ongoing application modernization. Those lagging behind have felt the impact on productivity, revenue, and competitiveness.AI is now reshaping this landscape even faster. From automated code transformation to intelligent dependency mapping and self-optimizing architectures, AI has become the force multiplier that makes modernization faster, safer, and more cost-efficient than ever before. Businesses investing early in AI-assisted modernization are already seeing shorter timelines, stronger security, and dramatically improved application resilience.For organizations planning their next modernization move, the message is simple: start now, start smart, and choose the right partner to navigate complexity with confidence.If you’re ready to modernize your applications and future-proof your business, Radixweb’s modernization experts can help accelerate your journey with clarity and precision.Connect with our experts today.Want even more interesting technologies-related statistics and facts? Check out NodeJS Statistics, Agile Statistics, Front End Statistics and JavaScript Statistics from Radixweb’s Facts and Figures library.

Ready to brush up on something new? We've got more to read right this way.