Read More

Discover what’s next for AI in healthcare in 2026 - Get Access to the Full Report

On this page

Summary: The global ‘AI in Banking’ market is expected to grow at a CAGR of 31.8% between 2024 and 2030. This rapid rise shows the expanding scope for using AI for banking businesses. From industry-agnostic solutions like chatbots to specialized solutions like risk mapping and predictive buyer profiling, the impact of AI in the banking industry is rapid and revolutionary. Read on as we walk you through the benefits, challenges, and use cases of AI in banking. Plus, a simple framework to help you navigate the implementation pathways.

Long gone are the days when people visited bank branches and waited in queues for customer support agents. Today, everything happens online. More importantly, everything happens automatically.

How? With artificial intelligence for the banking industry.

Whether you want to check your bank balance, make a transaction, find the best loan or insurance plans, or get your questions answered, you have an AI banking agent helping you do that. But if you think AI agents are all that artificial intelligence has to offer the banking industry, think again. At the backend, AI systems are helping banks profile customers with the highest credit risks, automatically approving and disapproving loan applications, and pushing relevant banking products to the right leads at the right time. These are just some examples of AI use cases in banking.

The overall impact of AI in the industry is much larger and expected to continue growing. By 2030, the AI in banking market will be worth $143.56 billion. So, dive in to see what this means your business, your customers, and the banking industry in general.

What is AI in Banking?

AI in banking refers to the use of advanced technologies like machine learning, natural language processing, predictive analytics, and automation to improve how banks operate and how customers experience financial services. At its core, artificial intelligence in banking enables systems to think, learn, and make decisions like human analysts, but faster, at scale and with more accuracy.

Simply speaking, AI and banking work together to streamline processes that traditionally require large teams and long turnaround times. From analyzing millions of transactions in seconds to identifying fraud patterns that humans might overlook, AI has become foundational to modern FinOps.

With the use of AI in the banking industry,

- Complex workflows are getting automated

- Operational costs are coming down

- Decision making is improving

Even in customer facing scenarios, AI in the banking sector powered VAs, personalized marketing funnels, and real-time financial planning tools.

But we also need to remember that the role of AI in banking is to augment human experience, not replace it. It allows banks to operate smarter, respond faster, and deliver better to customers while maintaining security, transparency, and trust.

How Did the Role of AI in Banking Evolve Over the Years?

The role of AI in banking has transformed dramatically over the past couple of years. It has gone from simple, rule-based systems to highly intelligent, data-driven models. AI today powers nearly every layer of modern FinOps.

Here's a walkthrough of the impact of FinTech on banks and how they have embraced AI over the decades:

- 1990s – Early Automation Begins

- Rule-based systems introduced to support basic decisioning and automate repetitive back-office tasks

- Early fraud detection tools emerged to flag suspicious transactions

- Initial experiments with AI in the banking sector focused mainly on improving process efficiency

- Online banking adoption created immense data streams, enabling basic predictive models

- Banks used early machine learning for credit scoring and customer segmentation

- Growing interest in the use of AI in banking for compliance reporting and operational risk

- ML algorithms enabled more dynamic fraud detection and credit risk assessment

- Chatbots and customer-facing automation entered the mainstream

- Foundations of modern AI in the banking industry took shape as mobile-first ecosystems grew

- NLP-driven virtual assistants began handling real-time customer support at scale

- Hyper-personalized insights, product recommendations, and predictive alerts became standard

- Banks accelerated investment in AI and banking convergence to improve customer satisfaction and reduce costs

- End-to-end process automation strengthened with Intelligent Document Processing (IDP)

- AI-driven fraud, AML, and real-time risk monitoring systems became enterprise-wide priorities

- Global institutions adopted advanced AI governance as AI in banking solutions became central to operations

- Autonomous banking systems capable of self-learning and self-optimization

- Advanced predictive engines powering real-time financial decisioning for both banks and customers

- Expansion of AI use cases in banking, from fully automated loan underwriting to next-generation cybersecurity

- Widespread deployment of AI tools for banking to enhance compliance, risk, and regulatory intelligence

- Embedded AI across channels, making using AI in banking a default expectation rather than a competitive advantage

What are the Most Common Use Cases of AI in the Banking Industry?

Contrary to what most people would assume, the use cases of AI in banking go beyond basic chat support. Here are the top 10 use cases of AI in banking:

1. Detecting and preventing financial fraud

AI uses ML and predictive analytics to monitor transaction data in real-time. It helps detect anomalies and suspicious patterns that deviate from a customer's normal behavior, thus detecting and preventing fraud.

Mastercard, for example, uses generative AI for card fraud detection. Their AI system analyzes large volumes of transactions to identify fraud patterns faster. This analysis helps significantly reduce false positives while maintaining high fraud prevention.

2. Conversational AI and Customer Service

AI-powered chatbots and virtual assistants use NLP to understand customer queries, automate routine support, and offer round-the-clock access to banking services.

Bank of America's virtual financial assistant, Erica, stands out as one of the most stellar examples of artificial intelligence in banking. Available on the mobile app, Erica has handled billions of interactions. Customers can use it to check balances, pay bills, make transfers, track spending, and even offer personalized financial insights and guidance on checking their FICO score.

3. Credit Scoring and Loan Decisioning

AI models are being used to analyze traditional and non-traditional data (like utility payments, online behavior, transaction analysis, etc.) create a holist view of creditworthiness. This results in faster and potentially more inclusive lending decisions.

Accumn, for example, deploys AI to transform lending and underwriting. For MSME loans, instead of simply flagging short-term dips in bank balance (which is standard policy), their AI detects the seasonal nature of the dip (for example, post-festival cycle). It then suggests approval with data-backed reasoning, ultimately speeding up turnaround time for credit managers.

4. Regulatory Compliance and Anti-Money Laundering (AML)

With AI, banks are automating the monitoring of large-scale transactional data to detect suspicious activity, which may be an indicator of financial crime. This rise of RegTech helps reduce the massive workload of compliance analysts by speeding up the process, while also reducing false positives.

For example, HSBC has been using advanced ML techniques, including graph-based pattern recognition for detecting complex, interlinked money laundering schemes. By training models to focus on high-risk alerts and contextual patterns, they have achieved significant reductions in false positives and missed signals, which helps analysts focus on genuine threats.

5. Risk Management

Artificial intelligence uses predictive modeling and stress testing to forecast potential market shifts, assess credit risk across the entire loan portfolio, and manage operational risk.

Santander, for example, integrates predictive analytics models to identify at-risk customers before they default on loans. This early warning allows the bank to proactively intervene with tailored financial advice or restructuring options, mitigating risk and improving customer retention.

6. Personalized Banking and Recommendations

Personalization has become a must-have instead of a nice-to-have today. Customers expect hyper-personalized advice, product recommendations, and timely alerts in banking too. AI agent development is what makes it possible.

DBS Bank (Singapore) is often cited as one of the most advanced banks in this use case of AI. DBS handles overs 45 million hyper-personalized customer interactions every month. The AI delivers real-time insights, such as alerts for upcoming subscriptions, renewals, and even suggestions to move excess funds to higher-interest savings accounts, driving significant business value.

7. Algorithmic Trading and Portfolio Optimization

In investment banking and wealth management, AI algorithms analyze vast data, news, latest updates, and market sentiments in real-time. This enables executing high-speed trades and optimize investment portfolios.

Platforms like Wealthfront are known to have AI-powered robo-advisors for this. With AI, the platforms assess a client's risk appetite, financial goals, and time horizon to automatically create, rebalance, and optimize diversified investment portfolios with minimal human intervention.

8. Cybersecurity

AI continuously monitors network activity and user behavior logs which helps quickly detect, prevent, and respond to sophisticated cyber threats and insider threats in real-time.

Many large financial enterprises use AI-driven Security Orchestration, Automation, and Response (SOAR) platforms. These systems automatically correlate millions of event logs, filter out false-positive security alerts, prioritize real threats, and even initiate automated response workflows, dramatically reducing the time it takes to contain a cyberattack.

9. Document Processing and Automation

Intelligent Document Processing (IDP) uses AI (OCR, NLP) to automatically extract, classify, and validate data from various structured and unstructured documents, such as loan applications, KYC forms, and invoices.

JPMorgan Chase's COiN (Contract Intelligence), for example, uses AI and ML. The system rapidly reviews commercial loan documents, contracts, and other legal documents. It extracts key terms, clauses, and obligations in seconds, which has reportedly saved hundreds of thousands of manual work hours annually. JP Morgan has also invested significantly in AI with 200+ researchers working for them.

10. Sentiment Analysis and Customer Feedback

AI uses NLP to analyze massive volumes of unstructured customer data (like call center transcripts, chat logs, and social media posts) to gauge their sentiment and identify paid points and satisfaction drivers.

Several banks are constantly monitoring social media and news feeds using AI to detect spikes in negative sentiments today. These help them understand customer/market sentiment related to new product launches, system outages, and even branch experiences. These insights help initiate rapid, targeted public relation/customer support responses before issues escalate to brand crisis.

These AI in banking examples show the rapid industry adoption and the benefits of AI in banking. If you don’t want to get left behind, it is time you also start integrating AI into your banking workflows.

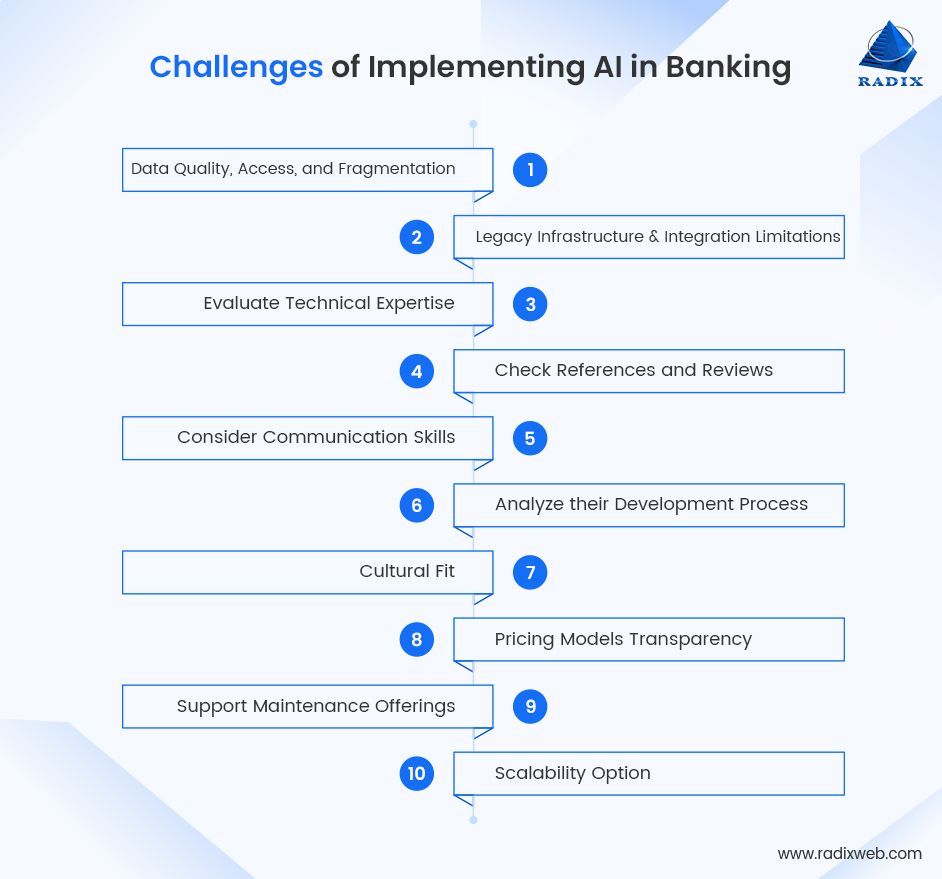

What Challenges Do Banks Face When Adopting Artificial Intelligence?

Banks and financial institutions across the globe are increasing their investment in artificial intelligence today. But implementing AI in banking is far from simple. Even with growing awareness and proven success stories, financial institutions still face structural, regulatory, technical, and cultural challenges. Navigating these challenges requires an acute understanding of the issues and deliberate planning before AI app development.

Below are the most common challenges of AI in banking:

Data Quality, Access, and Fragmentation

Banks generate massive volumes of data every day. But most of that data lives in outdated core systems or siloed departments and has issues like missing values and unstructured formats. AI models, however, need unified, consistent, and accessible data.

Cleaning, enriching, and integrating banking data, thus, becomes a major bottleneck. The poor data quality doesn’t just slow adoption but directly impacts the accuracy of the models used for fraud detection, credit scoring, and customer behavior prediction.

Legacy Infrastructure and Integration Limitations

Most financial organizations still operate on decades-old core systems. These systems were not built to support real-time analytics or machine learning workloads. These environments, thus, make it complicated and expensive to integrate AI into the banking sector.

API limitations, lack of cloud readiness, and rigid architecture mean banks must either heavily customize their existing systems or consider large-scale modernization, both of which increase costs and risks.

Regulatory Demands and the Need for Explainable AI

Finance is one of the most heavily regulated industries. That’s why it is important that every AI-driven or AI-assisted decision must be explainable and auditable. Many advanced models, especially deep learning models, work as black boxes, which makes it difficult for banks to justify decisions to regulators. Thus, while developing a banking app, ensure compliance with Know Your Customer (KYC) and Anti Money Laundering (AML) rules, fair lending policies, and emerging AI governance standards, significantly slows the deployment of AI in the banking industry.

Cybersecurity Risks and Vulnerabilities

As banking workflows become more automated, the surface area for cyberattacks increases. Using AI for fraud detection or risk management also exposes banks to new threats. These can include adversarial attacks that manipulate model inputs or system behavior. In addition, malicious actors can use AI offensively to scale fraud attempts. This dual-edged nature of AI requires banks to invest in more advanced security controls and continuous monitoring.

Bias, Ethics, and Model Fairness

AI models reflect the data they are trained on. If historical datasets contain bias (related to gender, geography, or other socio-economic factors), it can lead to unfair outcomes like discriminatory loan approvals or unequal credit limits. Banks must constantly audit their models to ensure fairness and ethical outcomes. Without strong governance, the use of AI in banking can unintentionally harm customers and expose institutions to legal and reputational risks.

Shortage of Skilled Talent

Implementing and scaling AI and banking initiatives requires specialized skills across AI programming languages, data science, cloud engineering, cybersecurity, model governance, and domain-specific expertise. Most banks face a significant talent gap in these areas. They either rely on small internal teams or external teams which slows down innovation.

High Costs and Uncertain ROI

Building a dependable AI ecosystem involves investing in data infrastructure, cloud migration, model development, regulatory frameworks, and continuous model tuning. For many financial institutions (especially small and mid-sized), the upfront investment is substantial. Additionally, AI benefits often accrue gradually, making ROI unpredictable and difficult to measure in early stages.

Change Management and Cultural Resistance

AI adoption also creates internal resistance. Employees may fear automation replacing their roles, or executives may hesitate due to unfamiliarity with the technology. Without proper communication, reskilling initiatives, and governance structures in place, organizational resistance slows the rollout of AI in banking solutions.

Despite the challenges of AI in banking, banks continue to move toward intelligent automation because the long-term gains far outweigh the early challenges. With clear governance, a strong data foundation, strategic investment in AI tools for banking, and dependable AI consulting support, institutions can gradually overcome these barriers and unlock the full potential of artificial intelligence.

How to Implement AI in your Banking Setup?

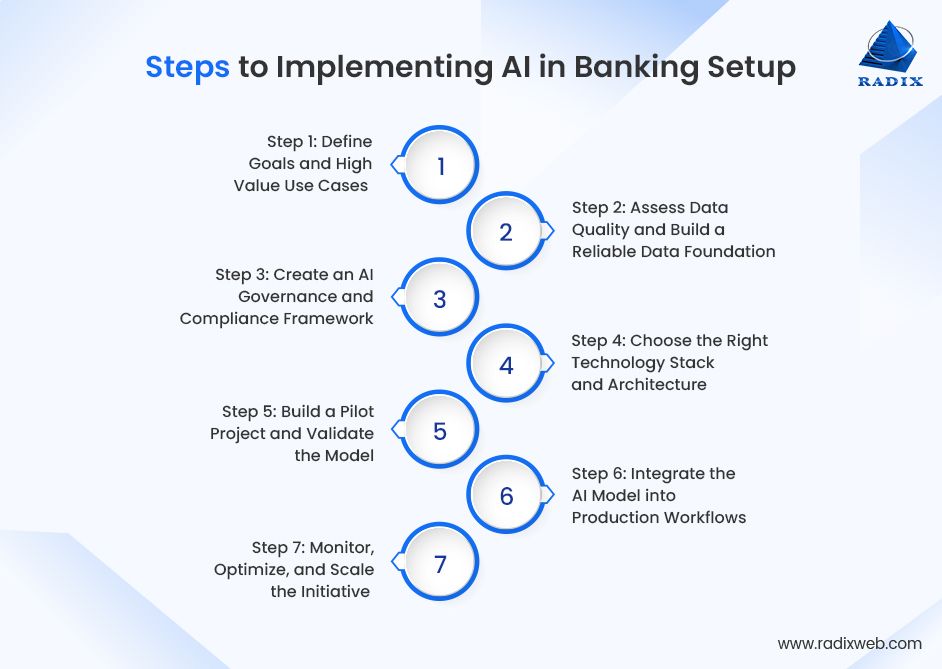

Implementing AI in banking requires more than just hiring an AI developer. It requires a structured, strategic approach. Rather than jumping straight into tools and models, you should build the right foundations with data, governance, and operational readiness. Here’s a streamlined, practical roadmap to help you plan and execute AI adoption effectively.

Step 1: Define Goals and High-Value Use Cases

Start by identifying where artificial intelligence in banking can deliver the most impact. It can be anything from fraud detection to customer service, loan decisioning, personalization, or document automation. No matter what your goals are, establish measurable KPIs so that the team knows what success looks like.

Step 2: Assess Data Quality and Build a Reliable Data Foundation

The success (or otherwise!) of artificial intelligence depends on clean, consistent, and accessible data. So, before rolling out AI models, review your current data sources. You’ll need to unify fragmented datasets and set standards for accuracy, governance, and security. Without strong data fundamentals, even the best AI in banking solutions won’t produce meaningful results.

Step 3: Create an AI Governance and Compliance Framework

Given the regulatory sensitivity of the banking sector, make sure you set up governance and compliance frameworks for AI implementations. You’ll need explainability guidelines, audit documentation, and risk controls. This ensures that every model meets regulatory expectations.

Step 4: Choose the Right Technology Stack and Architecture

Determine whether cloud, hybrid, or on-prem architecture fits your operational and regulatory needs. Select platforms, MLOps pipelines, and AI tools for banking that integrate smoothly with your core systems. As a trusted AI in banking services provider, we typically recommend agile, modular architectures that can scale over time.

Step 5: Build a Pilot Project and Validate the Model

Start small. Develop one well-defined pilot using historical or synthetic data. Validate the model not only on accuracy but on business outcomes like improved decisions, reduced risk, or faster processes. Successful pilots help build confidence internally.

Step 6: Integrate the AI Model into Production Workflows

Embed the model into daily operations with APIs or event-driven triggers. Ensure performance reliability, low latency, proper failovers, and continuous monitoring. This is where using AI in banking starts delivering real value across teams and customers.

Step 7: Monitor, Optimize, and Scale the Initiative

Once live, continuously review model performance, detect drift, and refine inputs. Use the insights gained to scale additional AI in the banking industry capabilities across risk, compliance, customer experience, and operations.

Implementing AI is a gradual journey, but with the right planning and execution, banks can unlock significant value while staying compliant and ready for the future of AI in banking.

Getting Started with AI in BankingThe future belongs to banks that proactively embrace AI and move beyond experimentation into real operational transformation. Customer expectations are shifting fast, regulatory clarity is improving, and the advantages of artificial intelligence in banking are now too substantial to ignore. This is the ideal moment to take action and build momentum rather than wait for competitors to set the pace.Whether you’re planning your first pilot or scaling AI across departments, having the right banking software development partner accelerates the journey.At Radixweb, we bring deep expertise in delivering end-to-end AI in banking solutions, helping banks modernize securely, efficiently, and at scale. If you're ready to move forward, schedule a consultation with Radixweb and explore how to turn your AI vision into tangible outcomes.

Frequently Asked Questions

How is AI transforming the banking industry?

How much does it cost to implement AI in banking operations?

How does AI improve security and fraud detection in banking?

How can banks ensure compliance and ethical use of AI?

Ready to brush up on something new? We've got more to read right this way.