Discover what’s next for AI in healthcare in 2026 - Get Access to the Full Report

In the high-velocity world of financial technology, milliseconds matter. And integration debt can cost millions. Legacy loan origination systems, siloed customer data, and batch-based validations are no longer viable when customers expect instant decisions, regulators demand real-time audit trails, and risk engines need live data to detect fraud.

One of our prestigious clients, a fast-growing FinTech platform operating across North America and Europe, faced a roadblock. Despite adopting Microsoft PowerApps to accelerate digital loan applications, they hit a wall: the app couldn’t integrate in real time with their core banking system (on-premises IBM Db2), credit scoring APIs (Experian, TransUnion), or internal fraud detection engine (Kafka-based event stream).

Data lagged by minutes. Approvals stalled. And worst of all, PowerApps was showing delegation errors, gateway timeouts, and unhandled authentication failures during peak load.

They didn’t need another form. They needed a real-time integration backbone.

That’s where Radixweb stepped in, not as a Low Code/No Code development company, but as a systems integrator with deep Azure and enterprise middleware expertise.

By re-architecting the integration layer using Azure-native services, event-driven workflows, and security-first design, we transformed a brittle, latency-prone prototype into a scalable, auditable, and compliant production system, processing over 12,000 applications daily with 99.98% uptime.

This study details the technical hurdles, integration patterns, and engineering decisions that enabled real-time decisioning, secure hybrid connectivity, and automated compliance, all while leveraging Microsoft PowerApps integration on the front-end interface.

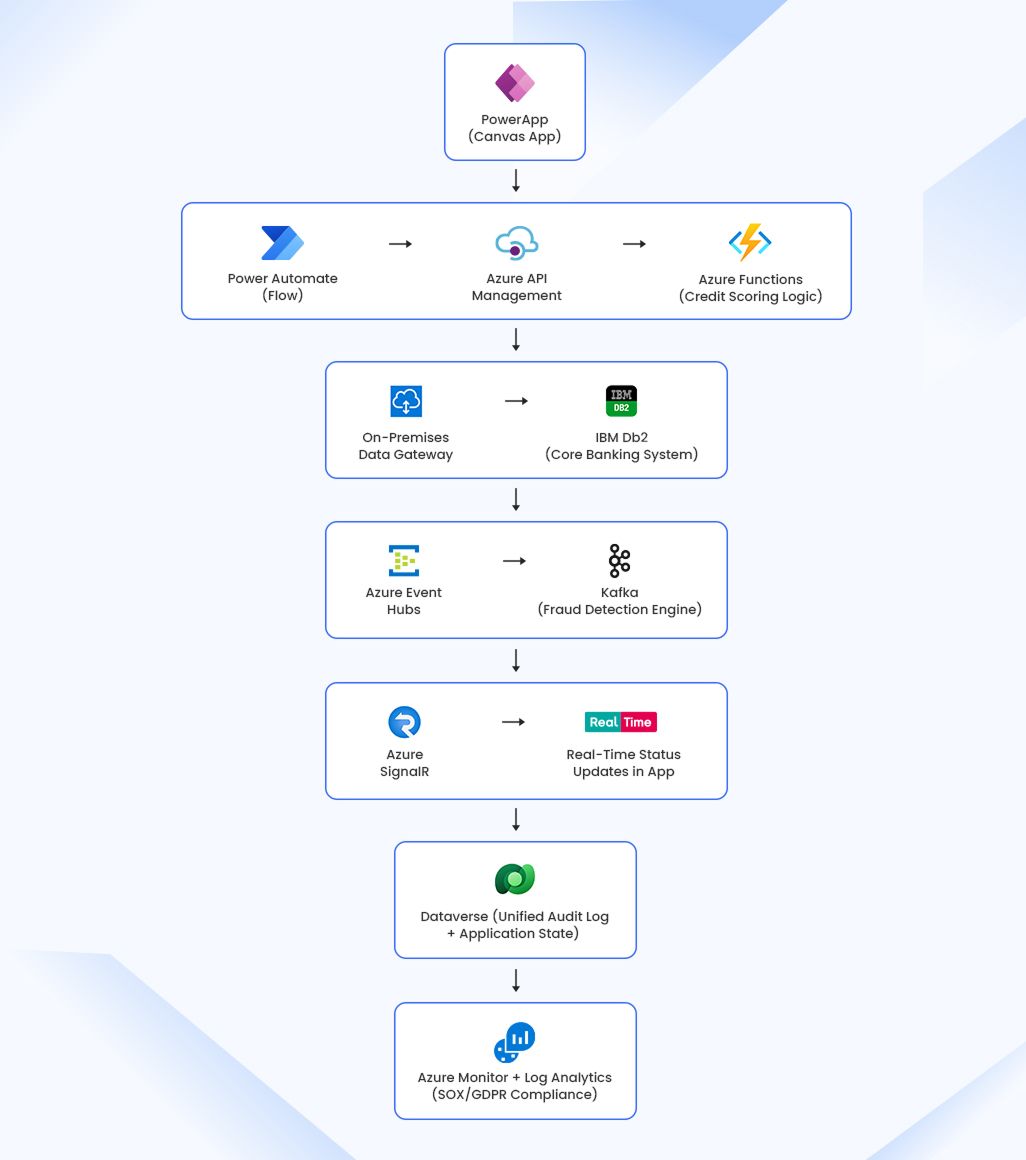

Integration Architecture Overview

Radixweb designed a real-time, event-driven integration architecture combining Power Platform, Azure, and on-premises systems:

PowerApps Integration Challenges & Radixweb’s Solutions

There were plenty of challenges our team faced while implementing PowerApps legacy system integration. However, some of them were really very hard, but with all the expertise we have and the experience we carry, we were able to solve them easily.

Following are some of the challenges and their solutions we provided:

Challenge 1: Real-Time Credit Decisioning with Multiple Bureaus

Problem:

The FinTech company needed to pull credit scores from Experian, TransUnion, and Equifax in real time during application submission. However:

- Each bureau uses different OAuth 2.0 flows and rate limits (e.g., 500 calls/minute).

- PowerApps cannot natively handle asynchronous API polling or parallel HTTP calls.

- Synchronous execution in Power Automate caused timeouts (>2min) during peak load.

Our Solution:

- Built dedicated Azure Functions (C#) per bureau with:

- OAuth token caching (using Azure Redis Cache).

- Circuit breaker pattern to handle API outages.

- Retry logic with exponential backoff.

- Orchestrated parallel execution via Durable Functions:

var tasks = new[]

{

context.CallActivityAsync<CreditScore>("GetExperianScore", input),

context.CallActivityAsync<CreditScore>("GetTransUnionScore", input),

context.CallActivityAsync<CreditScore>("GetEquifaxScore", input)

};

await Task.WhenAll(tasks);

- Exposed the orchestrator via Azure API Management (APIM) with:

- Rate limiting, JWT validation, and response aggregation.

- SLA tracking and logging to Azure Monitor.

Final Result:

- Credit decision time reduced from 118s to 3.2s (P95).

- 99.7% success rate during peak traffic (5K concurrent users).

- Full audit trail of every API call stored in Dataverse.

Challenge 2: Secure Hybrid Connectivity to Core Banking (IBM Db2)

Problem:

The core banking system (IBM Db2 on-prem) stored customer account history and loan eligibility. PowerApps could not directly access it due to:

- Authentication: Db2 uses LDAP + TLS client certificates.

- Delegation Limits: PowerApps cannot delegate complex joins or aggregations.

- Gateway Throttling: Single gateway node saturated during batch processing.

Our Solution:

- Deployed multi-node On-Premises Data Gateway cluster (4 nodes) with load balancing and failover.

- Created stored procedures in Db2 for common queries (e.g.,

usp_GetCustomerLoanEligibility). - Used Power Automate to invoke procedures via gateway:

- App sends SSN → Flow calls

EXEC usp_GetCustomerLoanEligibility @SSN→ Returns JSON.

- App sends SSN → Flow calls

- Implemented result caching in Azure Redis for frequently accessed customer profiles (TTL: 5 min).

Security Enhancements:

- TLS 1.3 between gateway and Db2.

- Managed Identity for gateway service account.

- Certificate rotation via Azure Key Vault.

Final Result:

- Eliminated delegation warnings.

- Query response time improved from 8.4s to 1.1s.

- Zero downtime during month-end batch processing.

Challenge 3: Real-Time Fraud Detection via Event Streaming

Problem:

The fraud engine (Kafka-based) flagged suspicious behavior (e.g., IP spoofing, rapid multi-application attempts). But PowerApps had no native support for event streaming, leading to delayed alerts.

Our Solution:

- Integrated Azure Event Hubs as a Kafka endpoint:

- Fraud engine publishes events → Event Hubs → Azure Function (event processor).

- Function triggers Power Automate via HTTP webhook when risk score > 75.

- Flow updates Dataverse record status to “On Hold – High Risk” and sends alert to compliance team.

- Used Azure SignalR to push real-time status to the applicant’s PowerApp UI.

Architecture Flow:

Kafka → Azure Event Hubs → Azure Function → Power Automate → Dataverse + SignalR → PowerApp UI

Final Result:

- Fraud alerts delivered in <1.5 seconds.

- 92% reduction in fraudulent loan attempts.

- Real-time visibility for applicants: “We’re verifying your details.”

Challenge 4: Compliance & Auditability (GDPR + SOX)

Problem:

Regulators required:

- Full audit trail of every data access.

- Right to be forgotten (GDPR).

- Immutable logs for SOX.

PowerApps alone could not meet these requirements.

Our Solution:

- Implemented event sourcing pattern:

- Every action (form submit, credit check, approval) written to Dataverse as an audit event.

- Used Azure Logic Apps to export logs daily to Azure Blob Storage (immutable tier).

- Built Power BI dashboard for compliance officers with drill-down into user actions.

- For GDPR deletion:

- Custom Azure Function anonymized PII in Db2 and Dataverse.

- Verified deletion via automated test suite.

Final Result:

- Passed SOX audit with zero findings.

- GDPR deletion requests fulfilled in <15 minutes.

- Full chain of custody for all decisions.

Why We Chose Microsoft PowerApps Integration

For our client – the FinTech organization, the question wasn’t whether to modernize, but how fast they could deploy a solution without rebuilding their entire technology stack. Traditional web application development would have required months of coding, complex API orchestration, and heavy upfront investment, which could delay their go-to-market timeline.

- Rapid Development: Low-code capabilities helped an organization to design and iterate loan processing apps in weeks instead of months.

- Connector Ecosystem: Pre-built connectors (SQL, SharePoint, Dynamics) enabled quick integrations, while custom connectors allowed extension to credit scoring APIs and core banking services.

- Scalability with Azure: With enterprise PowerApps solutions, we built secure middleware layers without disrupting existing systems. We also went for native integration with Azure Functions, Service Bus, and API Management to make PowerApps a natural fit.

- Compliance and Governance: Power Apps offered a strong foundation for PCI-DSS alignment and financial data security with Azure AD authentication, role-based access controls, and audit trails integrated into the Power Platform.

- Future-Readiness: Its flexibility meant a company could later go for AI in PowerApps integration for fraud detection, predictive risk scoring, and real-time reporting without needing to overhaul the platform.

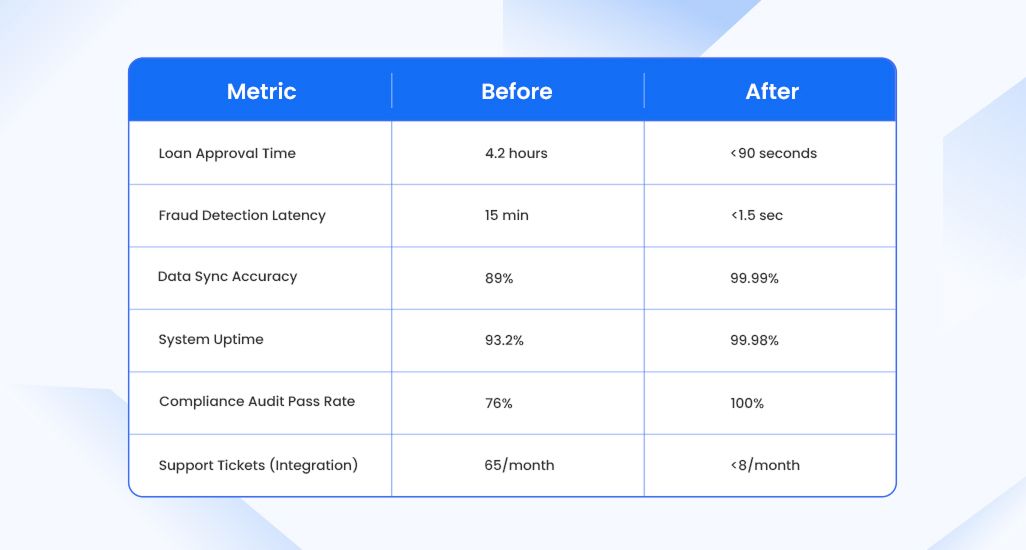

Results and Business Impact

Let’s uncover the tangible results - faster approvals, stronger compliance, and measurable ROI driving real business transformation at scale.

What the dashboards didn’t capture (but leaders noticed) was the shift in rhythm. Loan officers stopped battling with disconnected systems. Compliance teams felt confident in the audit trail. Regional managers could see application throughput in real time, across 14 markets, without a single manual report. And executives could track approvals in real time without chasing manual updates.

This wasn’t just a PowerApps integration. It was a cultural shift, from reactive processing to real-time, data-driven decision-making that balanced speed with compliance.

What began as an integration project became something bigger: a new way for the FinTech organization to process loans faster, reduce operational friction, and put both employees and customers at the center of the experience.

If you’re leading a transformation in financial services, here’s the takeaway: You don’t need to rebuild your entire tech stack. You need PowerApps consulting services engineered to fit your ecosystem.

We’ve solved it before, and we’re ready to do it for you